Long/short of volatility swaps as a pure volatility trade between EUR/USD/JPY, we recommend getting pure volatility exposure via a long short of volatility swaps.

This allows for getting rid of systemic delta hedging and more generally of most of the gamma risks.

The pay-off of these instruments depends on realized volatility, but their market to market (vega) is sensitive to implied volatility as well.

Indicative bid: Receive 3.4 vols (USD notional on both legs), we expect the implied vol spread to converge towards one volatility point. We recommend unwinding the position before the expiry as soon as the net profit exceeds this level.

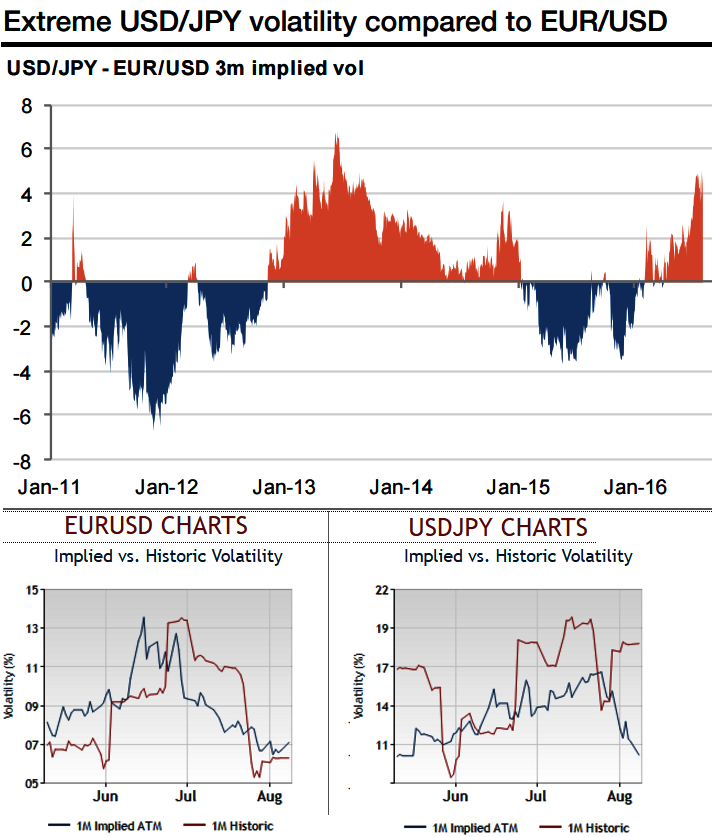

Rationale: Volatility relative value opportunity with asymmetric risk profile, the spread between USD/JPY and EUR/USD 3m volatilities is very wide, exceeding three volatility points (see Graph) and Please be aware of clear divergence between 1m IVs and HVs of USDJPY. This is not sustainable, and we expect a tightening.

Risk profile: A Further divergence between EUR/USD and USD/JPY volatility, new uncertainties in Japan (BoJ easing in September?) could generate yen turbulence.

Investors holding the position until the 3m expiry face unlimited losses if the realized volatility between USD/JPY and EUR/USD eventually exceeds 3.4 vols.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential