Brexit factors: Negotiations between the UK and EU seem to have progressed in recent times. A combined message from both Brexit Secretary Davis and EU chief negotiator Barnier indicated both blocs had broadly agreed to a post-Brexit transition period, running until December-2020. This is deemed as quite a positive move by the FX markets, with GBP finding good support.

Moreover, there was some concern that the thorny question of the Irish border could once again scupper a deal despite positive media reports of behind-the-scenes progress: it had appeared the EU was going to demand significant movement from the UK side if transition was to be agreed, but in the event, the EU chose not to force the issue and the relief for GBP was profound

Macroeconomic factors: The demand details in the third release of the 4Q GDP report were little changed, with consumption and business investment growth still soft (both 0.3% QoQ; 1.2% QoQ, SAAR). Export growth was revised down to leave net trade subtracting from 4Q GDP and making zero contribution to 2017 growth on average. In the income details, household real income stagnated in 4Q, although this was mostly down to weakness in employer social contributions and net social benefits.

Trade factors: While the UK’s net trade deficit has barely narrowed since sterling’s depreciation, there has been a clearer pickup in net investment income. This reflects higher income earned on foreign assets and is likely a consequence of both the weaker currency and the improved fortunes of the Euro area. As a result, the UK’s current account deficit narrowed again to 3.6% of GDP in 4Q’17, compared to the near-6% shortfall in 2016.

OTC indications:

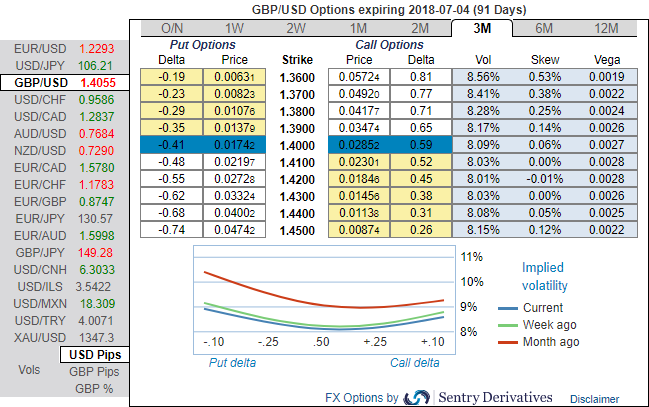

Let’s glance at sensitivity tool, the bearish neutral risk reversals across all tenors indicate the downside risks in underlying spot FX prices remain intact.

Positively skewed IVs of 3m tenors have been well balanced that signifies the hedging interests on both OTM put/call strikes that means the ATM instruments have a higher likelihood of expiring in-the-money, while balanced hedging sentiments on either side in comparatively shorter tenors are favorable to both call and put options holders’ advantages.

Hedging Strategy:

3-Way Options straddle versus Put

Spread ratio: (Long 1: Long 1: Short 1)

How to execute:

Go long in GBPUSD 3M At the money delta put, Go long 3M at the money delta call and simultaneously, short 1M (1%) out of the money put with positive theta.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned to -30 (which is bearish), while hourly USD spot index was creeping up at shy above 10 (neutral) while articulating (at 12:52 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data