OTC updates:

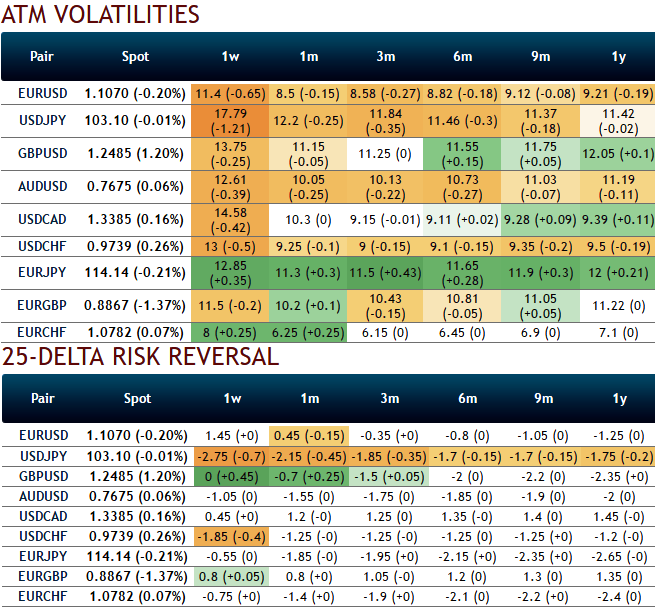

As per the nutshell showing implied volatilities and delta risk reversals, USDJPY is rising higher IVs of 1w tenors with hedging sentiments for downside risks in the tenor which is the highest among G10 currency space. While the long-term hedging arrangements for downside risks still appear to be intact. Hence, we recommend below option strategy so as to match the above fundamental as well as the OTC scenarios.

While USDJPY pin risk is seen in options expiring on this Friday at strikes 100.95, most importantly, as the OTC VIX USDJPY is the pair to have highest volumes.

VXY indices have barely moved on the week, however, demonstrating once again that the linkage between USD spot and vols has broken down.

In fact, the VXY G7 index would be down were it not for USDJPY vols lifting up 0.5vol on higher spot - in spite of the sign of the USDJPY risk-reversal being negative (see above nutshell showing further down, where we assess that the fair value of 3M RR 25D USDJPY should be flat based on spot-vol betas).

By this we mean FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices. That is, the spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

Fundamental outlook:

On the data front, the BoJ to maintained status quo at this MPM as widely expected despite the downward revision to the inflation outlook.

PMI, Shoko Chukin small firm survey, and real exports confirmed the manufacturing is gaining momentum.

The consumption stopped decreasing in September and is expected to rebound in Q4.

CPI trend inflation in Japan continued to decelerate in part due to the lagged effect of yen appreciation.

The currency could weaken significantly if expectations overseas for inflation pick up and moderate growth of around 2 pct in the U.S. can be achieved, facilitating Federal Reserve rate increases.

Option Trade Recommendation:

The spot reference of USDJPY is at 103.271, the least since 12th October. So if the market is blissful to add longs in USDJPY as a positively convex play on the BoJ meeting, the result of such demand is that USDJPY is now 2% expensive compared to the 10Y rate spread.

Well, on hedging grounds, hold a USDJPY put fly (104.777 x 103.271 x 102.388 in 1x2x1 notional) with 1w expiry.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure