NZD faces domestic headwinds to local rates that are only now being fully appreciated. Growth has weakened, the central bank’s inflation forecasts have been revised materially lower, net immigration is slowing and business confidence has fallen significantly since the change of government. The central bank is in a state of transition (new governor, new mandate), but the message that policy will remain accommodative has carried over from interim Governor Spencer’s term.

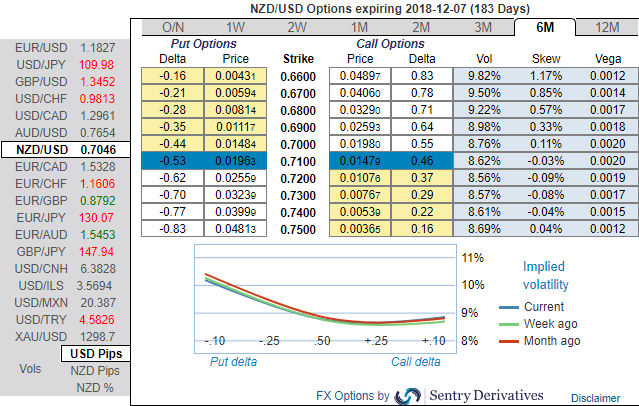

Bids on 3m skews have come in quite worthy, as they signaled the hedging interests for further bearish risks. Thus, we expect NZDUSD to depreciate to USD 0.68 by end of 3Q’19. Accordingly, we’ve recommended diagonal put ratio back spreads in order to participate both momentary upswings in the consolidation phase and anticipated downside risks.

The underlying pair has been spiking higher from the last couple of days (refer above technical chart), the upward correction shows no signs of fading, 0.7130 the next target (being a 50% retracement of April’s decline) if risk sentiment remains upbeat.

Well, for now, the medium term perspectives of this pair seems to be bearish as the US dollar remains in a two-month-old sideways range, which means further sideways ranging in NZDUSD is possible during the month ahead.

Further out, though, we are bearish. The NZ-US interest rate advantage is rapidly shrinking and should eventually weigh, pushing NZDUSD towards 0.69 by mid-year.

Moreover, the 6m skews are targeting towards OTM put strikes at 0.66 (refer above nutshell) which is in line with the above-mentioned projections.

Writing 1m at the money put with positive theta snaps momentary rallies, you could easily make out short legs on ATM puts would go worthless considering time decay advantage. Simultaneously, we uphold 2 lots of longs in 3m 1% OTM puts, the structure could be constructed at net debit.

It was explicitly stated that “Theta shorts are recommended in this strategy because, Theta is not a constant, it changes as the underlying market moves and time passes. Theta is the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.”

Hence, on hedging grounds, the option the holder of OTM puts still desirable and is deemed to be on upper hand.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 8 levels (neutral), while hourly USD spot index was at -69 (bearish) while articulating at 10:46 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data