The NZD has under-performed considerably post-RBNZ monetary policy and the Trumps victory. Concerns about exports, plus a stronger US dollar, are at play.

The FxWirePro NZ dollar strength index flashing up with negative 72.962 even after last weeks’ central banks easing at record 1.75%.

While NZ fundamentals remain strong, the NZD will bear a risk premium linked to the threat to Asian trade volumes from the Trump win.

There is also a minor headwind (so far) from today’s earthquakes, the extent of damage likely to take some time.

NZ events this week are second tier, apart from perhaps the GDT dairy auction on Tue. which is predicted by futures to result in a 5% rise in whole milk powder (WMP). Otherwise, there’s REINZ housing data, services PMI (Mon), Q3 retail sales volume (Tue), Q3 PPI (Thu) and ANZ consumer confidence (Thu).

On the US calendar, Oct retail sales and CPI and the first of the Nov PMIs Philly and Empire) are the main releases of note but we suspect 10 Fed speak engagements along with any fresh details on Trump’s policy agenda will be the main focus this week.

3 months: We target 0.70- based on an assumption the Fed will hike in Dec. However the persistent backdrop of global demand for high-yielding currencies is strong - if the Fed doesn’t hike, then 0.75+ is likely instead.

As more dollar rallies into X’mas FOMC are foreseen, we also target 0.6950 or lower as long as the Fed tightens to 0.625% in December.

The strategy:

We target below 0.70, based on an assumption the Fed will hike in Dec and the RBNZ’s cut is still having the room to price in. However the persistent backdrop of global demand for high-yielding currencies is strong - if the Fed either doesn’t hike or signals very gradual tightening, then 0.75+ is likely instead.

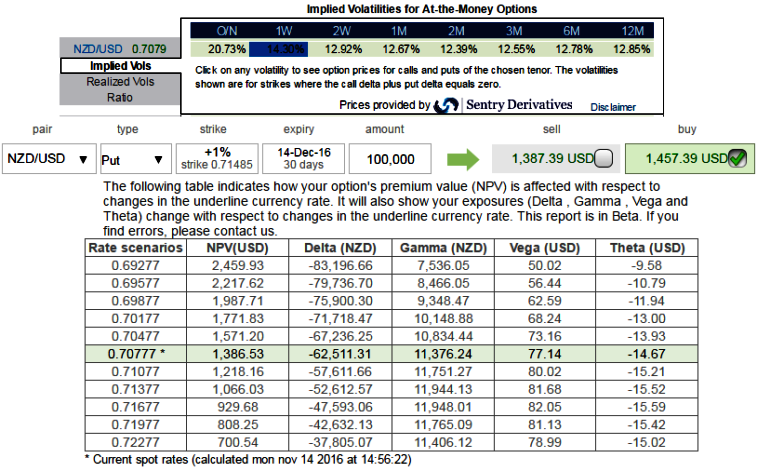

Contemplating all these underlying factors, to arrest these downside risks we advocate initiating longs in 1m (1%) ITM put option with net delta -0.71.

A higher (absolute) Delta value is desirable for an option buyer, whilst a Delta close to zero is desirable for the option seller as a buyer wants their option to become more valuable whilst a seller wants the option to become less valuable.

Rationale: Further dollar rally into December FOMC.

The FX market is still underpricing the likelihood of a Fed hike by year-end and RBNZ’s recent rate cut. We expect further gradual dollar gains into the December FOMC meeting.

Risk/return profile: No Fed cut and continued pro-carry macro environment, the key risks to the trade are that the RBNZ does not cut rates in November, the Fed does not hike by December, and the pro-carry global macro environment persists. The divergent policy expectations on the RBNZ and Fed are crucial for the trade to work.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom