While celebrating Christmas, we are geared up for the one more occasion. Yes, on the eve of New-year, AUDNZD contained between 1.0900 and 1.1000 in near run.

The medium-term perspectives: Momentum is negative following some AU data disappointments. 1.1016 looks vulnerable. The corrective decline which started in late Oct could reach 1.08, but one shouldn’t be surprised, even if it should eventually give way to a retest of 1.11 as long as AU economic data remains supportive and AU commodity prices outperform.

While a resumption of the major downtrend on cards, on the contrary, the uptrend which started in June should test 1.11, contingent on AU economic data remaining supportive, commodity prices recovering, risk sentiment remaining elevated, and NZ politics weighing on the NZD. The RBNZ outlook (on hold throughout 2018) is anchoring the pair to hit 1.08 areas.

Trade DNT’s: Contemplating both short term and long term technical of AUDNZD, we recommended certain yields but a limited loss structure via double-no-touch optionality in next 1-month, AUDNZD 1m DNT with 1.1150/1.0750 strikes (maintained 50 pips as a tolerance on either side) – we are reluctant to sell volatility outright given the unquantifiable risk. However, shorting volatility and fading the spike in skew through limited loss structures (i.e. DNT’s) could be appropriate.

On a hedging grounds, AUDNZD major downtrend has been drifting in consolidation phase but now jerky in the medium run, this may cause price slumps upto 1.08 levels (recent lows).

We expect the 1.0809 areas which can’t be disregarded if iron ore remains under downward pressure. A retest of the 1.10 area seen in April is also possible if iron ore’s rally since mid-June continues and global risk sentiment remains elevated.

We’ve seen the bearish impact on underlying AUDNZD movement in the major trend. Technically, the price behavior has been weaker with both leading as well as lagging indicators are bearish bias.

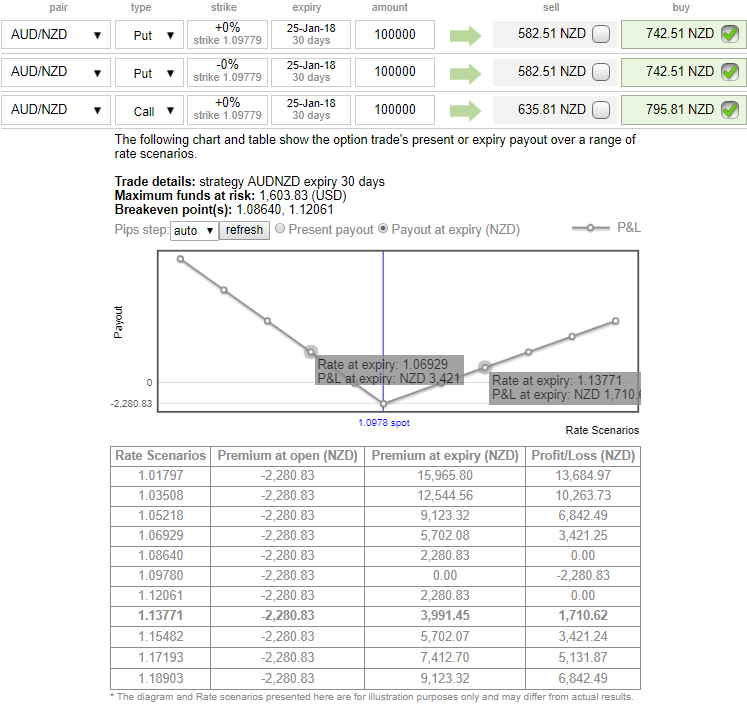

Contemplating above fundamental developments and the ongoing technical trend of this pair, to participate in the puzzling swings, we advocate option strips strategy that contains 3 legs of vega longs (2 puts plus 1 call). The option strips that likely to fetch desired yields regardless of the trend but more potential on southwards by arresting bearish risks.

As shown in the diagram, the execution goes this way: Initiate 2 lots of 1m longs in Vega put options, simultaneously, add 1 lot of Vega call options of the similar expiry, the strategy is executed at net debit.

Please be noted that the strategy is likely to derive positive cashflows regardless of the underlying spot FX moves with more potential on downside.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at 65 levels (which is bullish), while hourly NZD spot index was at shy above 21 (bullish) while articulating (at 06:02 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings