A glimpse on fundamentals:

German IP plunged, likely due to holiday distortions.

German VDA car production data already point to a big rebound in January.

German election thrown open by the change in SPD leadership, while in France Le Pen revealed her agenda.

Feb consumer confidence in Eurozone: Confidence printed -4.9 in Jan which is a high dating back to early 2015. Consumer confidence gained some momentum in late 2016 after a poor start to the year and a downturn around Brexit. Though recent GDP and manufacturing surveys have been more positive, given the ongoing political uncertainty that foreshadows 2017, it is difficult to see the index strengthening much further

OTC updates:

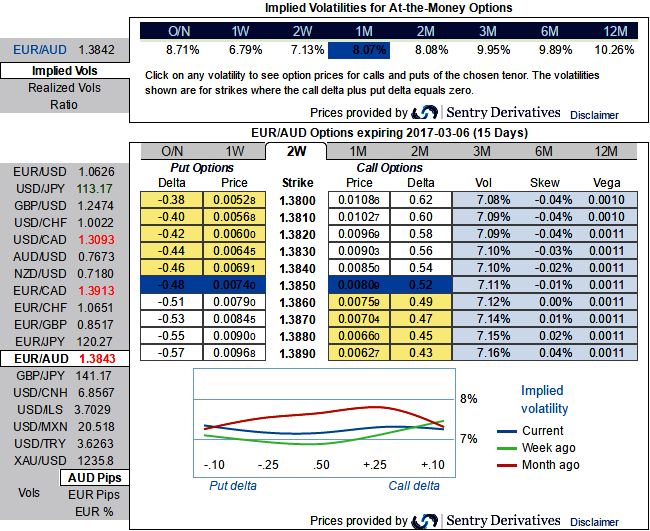

The implied volatilities of EURAUD ATM contracts are trading shy above 7.13% and 8.08% for 2w and 2m tenors respectively, while the spot price in technical trend approaching near crucial juncture at the support of falling wedge, it seems to be equal opportunity for both bulls and bears with option writers of deep OTM calls are on slight upper hand.

While positively skewed 2w IVs are signaling the luring opportunities in out of the money call writings as the IVs are also on a lower side which is conducive for option writers. Hence, we encourage 2w 1.41 EURAUD call.

Hedging Framework:

3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute:

At spot reference: 1.3840, initiate long in EURAUD 2M at the money +0.51 delta call, go long 2M at the money -0.49 delta put and simultaneously, short 2w (1.5%) out of the money call with positive theta.

Rationale on fundamental grounds: Euro area business and consumer surveys point to solid growth momentum in the region. Sentiment improved significantly during Q4’16 and remained robust in January, with the strong sector and country details. Consistent with this signal, Euro area GDP increased a solid 2% QoQ, SAAR in Q4’16 and was revised up for Q3 in the flash GDP report, published almost two weeks ago. Since then, the December plunge in German IP reported this week contradicted this positive message.

But, in our view, there are good reasons to fade this IP weakness, given that industrial orders were strong and that the VDA car production data already show a big rebound in January. The December IP drop could lead to a slight downward revision to Q4’16 Euro area GDP but should be compensated in Q1’17. Moreover, elections in this region are likely to add turbulence to the FX markets.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics