As Fed’s anticipation, the US CPI has been increasing towards its projection, The Fed has a 2 pct inflation target and tracks an inflation measure which is currently at 1.7 pct. The consumer prices in the US increased by 1.7 pct YoY in November 2016, following a 1.6 pct rise in October and in line with market expectations. It was the highest inflation rate since October 2014, mainly boosted by higher energy cost while food prices continued to fall.

The rising rents lifted underlying U.S. inflation in November, pointing to a steady build-up of price pressures in the economy that could support more interest rate increases from the Federal Reserve next year.

While on the other hand, crude prices have been on a rollercoaster ride over the last several years. After averaging $100-plus per barrel from mid-2013 through mid-2014, West Texas Intermediate prices fell as low as $29 per barrel this past February.

Even though energy has only a 7 pct weight in the consumer price index (CPI), the most popular measure of inflation, the price changes in the former can be so large that they have a meaningful impact on inflation.

Hence, the prospects of further monetary policy tightening in 2017 were also bolstered by other data on Thursday showing a drop in the number of Americans filing for unemployment aid last week.

The Fed raised interest rates on Wednesday for the second time since the 2007-2009 financial crisis and forecast three rate hikes in 2017. In addition to rising oil prices and a tight job market, inflation is likely to get a boost from U.S. President-elect Donald Trump's proposed expansionary fiscal policy agenda.

Amid geopolitical pressures in euro area and brexit in the UK, governments have abused their powers of money creation. Each newly-printed unit of government fiat currency gets its value by taking a small amount of value from each unit of existing currency.

Although Bitcoin would be somewhat inflationary in its early years, the 21 million cap would eventually keep Bitcoin as a deflationary currency. In the same way there is only so much gold in the world, there would be an inadequate quantum of cryptocurrencies.

As a result, the deflationary spiral is likely to occur in cryptocurrency market due to the limited price stability has a negative impact on the acceptance of a currency. Vendors do not wish to speculate on the price of currency when selling goods or services.

Once prices do stabilize in the future, there will always be the knowledge that the number of Bitcoins in the market is limited. As a result, to the extent the GDP of the Bitcoin economy increases (the total value of all Bitcoin transactions completed increases in "real" terms), there will continue to be price deflation.

As more gold is mined, less gold remains to be mined and it becomes increasingly difficult to extract new gold. The same remains true for Bitcoin, while demand/supply equation would favour the increase in price as the industry itself is in developing stage.

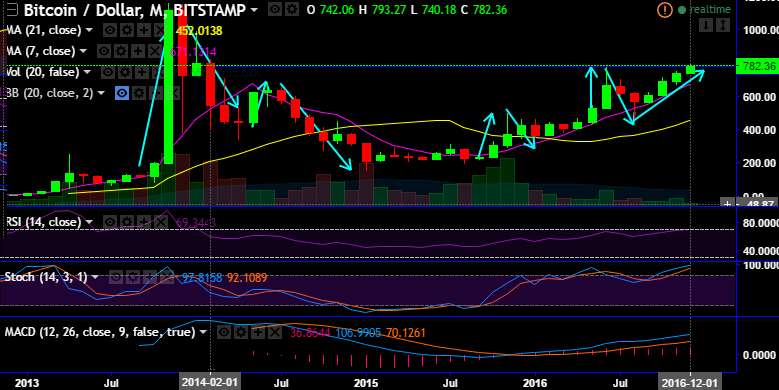

Evidently, from above technical charts, you could make out BTCUSD creeps up in the uptrend to hit 2 years highs at prevailing price of 782.36 (while articulating).

Hence, bitcoin offers an easy way for foreign traders to exit economies that revolve around speculative government’s fiat currency and astonishing monetary policy.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate