EURPLN has been attempting to bounce back from the lows of 4.1988 levels in the latest trading session, however, one could make out that the trend of the underlying spot FX moves is stuck in the range between 4.2159 and 4.1945 levels.

NBP concludes a two-day council meeting and announces its rate decision today: it is widely expected that no change to monetary policy will be made.

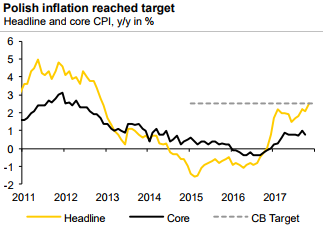

Nevertheless, this will be an interesting meeting because the central bank had been resolutely dovish in prior months, reiterating that inflation may not reach target until around 2019 – and then, we just had the inflation print for November which showed inflation hitting target already (see chart 2).

Unless this acceleration proves to be wholly driven by special factors (we will get a clearer picture when the data breakdown is published on 11 December), it would be surprising, indeed, if there were to be no change in language, no concerns within the MPC after this development.

The Polish zloty has appreciated remarkably, especially relative to peers, in anticipation that the MPC could turn more hawkish now. Given the manner in which hawks and doves are balanced at the moment – a change of view by Governor Adam Glapinski could suffice to trigger a rate hike – and this could occur during H1 2018 instead of our current base-case of H2 2018 – this is the main risk which is being priced in by the market.

We have now turned modestly constructive on the Zloty, given strong data momentum.The central bank’s dovish stance is unhelpful, but data may challenge it over coming months. Short-term valuations look cheap, demand for local bonds remains strong and the market is likely to discount political risks without any clear path for EU to impose Article 7 sanctions on Poland. We still acknowledge that PLN screens overvalued in our BEER FV framework.

Thus, we were already short in EURPLN spot, we recommend upholding below strategies:

Stay short in EURPLN spot, which is currently trading at 4.2046. The position generates carry of about +15bp per month. We target minimum 3.75% southward moves upto 4.1650, and place a stop-loss at 4.2650 levels.

Alternatively, options trading strategy has also been advocated.

At spot ref: 4.2046, we advocate entering a new EURPLN 1m2m diagonal call spread (4.1650/4.2650). The underlying spot FX trend and IVs are favorable to write ITM calls.

Rationale:

Consolidation of core rates. We believe that current valuations in PLN are attractive to establish a short EURPLN position. In our view, US and EUR rates may consolidate following the sharp re-pricing higher.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025