Banxico hiked 25bp; we see limited MXN gains but prefer calendar skews at the current juncture.

Banxico has hiked its policy rate 25bp to 6.5% and signaled a shift in gears towards a slower pace of tightening ahead.

Following the policy statement, JPMorgan updates its policy call and now looks for Banxico to hike 25bp in May and keep the policy rate stable at 6.75% thereafter.

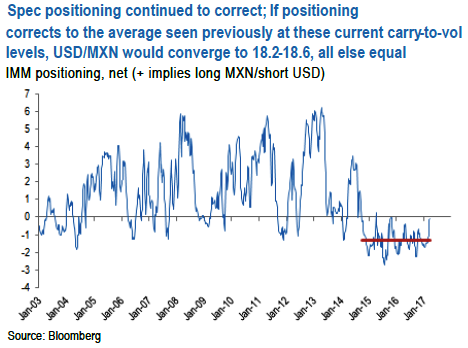

As discussed in a note published last week, attractive carry-to-volatility ratios should help the MXN in the medium term, and speculative positioning seems to have begun reacting to that– the last time carry-to-vol was at current levels, speculative positions were substantially long MXN.

If positioning corrects to the average seen previously at these current carry-to-vol levels, USDMXN would converge to 18.2-18.6, all else equal.

In all, higher Mexican rates and lower volatility make the MXN more attractive as a short-term trade, although we see limited capital gains at these levels.

Next week, the Trump-Xi meeting could cast light on US trade strategy going forward and could reverberate on USDMXN.

In the last few weeks, we have seen a material easing of the anxiety that had built around the NAFTA renegotiations.

Yet, there is no clarity yet on the US administration’s intentions for the NAFTA renegotiation, and we are still wary of the bargaining power that an existing Mexican administration will have, given Mexican Presidential elections are scheduled for June 2018.

As we see risks resurfacing in H2’17 and note that risk reversals look cheap, even when filtering out the impact of the recent ATM vol drop. Thus, we recommend buying gamma neutral calendar skews (sell 3M 25 delta put, buy 6M 25 delta call, in gamma neutral notionals).

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts