The minutes from the November Board meeting were broadly consistent with the narrative from the recent Statement on Monetary Policy, as expected.

The RBA continues to monitor the risks around the labor market, housing market, China, and private consumption, and continues to think that the “appreciating exchange rate could complicate this adjustment”.

Importantly, the assessment of risks around the inflation outlook appears more balanced, with the minutes suggesting to us emerging confidence that the disinflationary pulse has peaked.

We continue to see the RBA on hold with the cash rate steady at 1.5%over our forecast horizon (to end 2018).

FX option strategy:

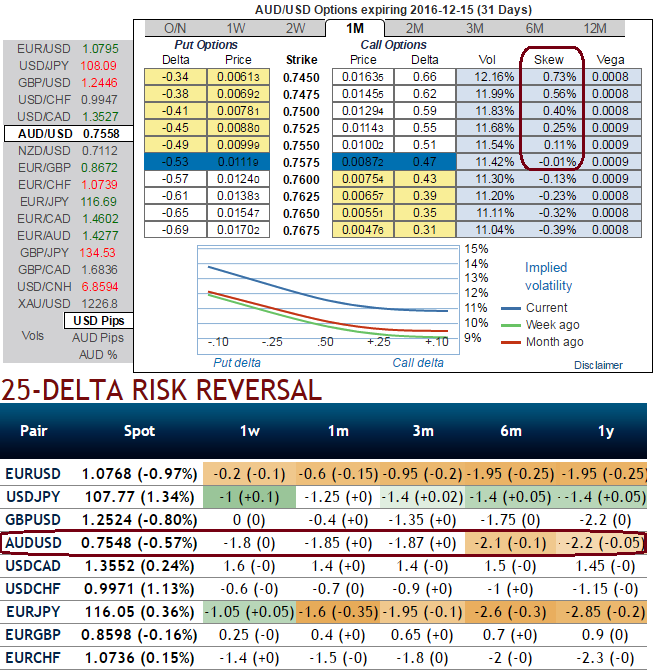

Although AUDUSD has been spiking in the recent past from the lows of 0.7523 to the current 0.7560 levels, the bears of this pair resuming at resistance of 0.7581 (day highs) levels, so hedgers can load up shorts in underlying pair via put options with longer tenors to arrest major downtrend as the selling momentum is intensified by leading oscillators with mammoth volumes.

So it is advisable to initiate Diagonal Credit Put Spread (DCPS) in order to tackle both short-term upswings and major downtrend.

To construction this strategy, we evaluated 1m IV skews with risk reversals of the same tenors, the positively skewed IVs towards OTM put strikes moving in sync with risk reversals bets on bearish risks.

Usually, pondering over the option sensitivity tool, IVs and OTC indications these puzzling could be optimally tackled and attained the trade or investment objectives via theta options of shorter tenors.

As we expect the retest of lows of 0.7440 in the weeks to come amid any abrupt upswings.

For the ease of understanding, we’ve just considered this option strategy with shorts in 1W (1%) ITM put with positive theta or closer to zero while buying 1M (0.5%) OTM put option; the strategy could be executed at a net credit.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data