If the RBNZ remains inflexibly on hold, as widely anticipated, and the US dollar rises on the expectation of further Fed interest rate rises in 2018, then NZDUSD should drop to 0.67 over the next few months.

OTC Outlook and Options Trade Recommendations:

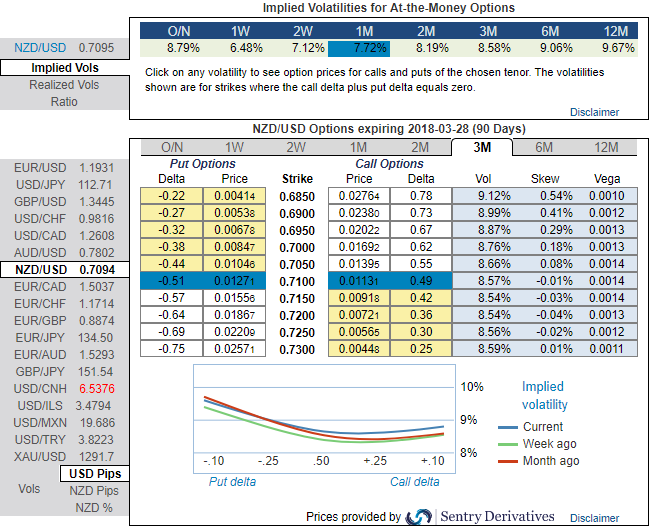

Let’s glance through nutshell evidencing IV skews that signify hedger’s bearish interests in next 3-months timeframe. Positively skewed IVs of this tenor signal underlying spot FX is expected to be lowering southwards as the skews have been flashing positive numbers on OTM strikes upto 0.6850 or below.

Please noted that the 1% out of the money puts of 1m tenors are exorbitantly priced over 22.5%, whereas this pair has been no exception from low vols environment, 1m IVs are just shy above 7.7%. Hence, the option premium of this OTM put is deemed as the overpriced instrument. Lower IV environment while rising underlying spot sentiments would be conducive for option writers of such overpriced puts.

Accordingly, at spot reference: 0.7092, since the 3m skews are targeting OTM put strikes at 0.6850, we’ve recommended put ratio back spreads in order to participate both momentary upswings in the consolidation phase and anticipated downside risks.

Hence, the strategy reads this way - writing 1m (1%) in the money put with positive theta snapping decisive rallies, you could easily make out short legs on OTM puts would go worthless considering time decay advantage. Simultaneously, we uphold 2 lots of longs in 3m 1% ITM puts, the structure could be constructed either at net debit.

Theta shorts are recommended in this strategy because Theta is not a constant, it changes as the underlying market moves and time passes. Theta is the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 108 levels (which is bullish), while hourly USD spot index was at -102 (highly bearish) while articulating (at 07:47 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate