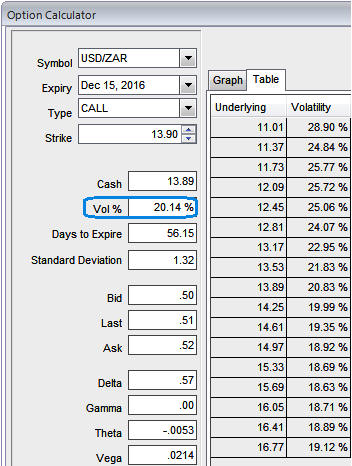

A glance at the implied 3-month volatilities illustrates the whole crux of the matter: at 19.9% ZAR is the currency with the highest volatility at present among G20 FX space.

The volatility of the rand is the expression of grave concerns amongst investors that the political situation in South Africa is getting further out of control.

On the one hand, there is President Jacob Zuma and his supporters who are implicated in various corruption scandals.

His counterpart is Finance Minister Pravin Gordhan, who is an internationally recognized expert and who the financial markets consider as a guarantor of the country’s financial policy stability.

If he was to be dismissed that would almost certainly cause the international rating agencies to downgrade South Africa. In the end, the development of the rand illustrates how difficult investors find it to judge and value the political situation in the Emerging Markets.

The inflation is likely to once again exceed the central bank’s (South African Reserve Bank, SARB) accepted the upper limit of 6%, having eased to 5.9% the previous month. In addition to Finance Minister Gordhan, the SARB is the second aspect supporting the rand on the international markets.

So far the SARB has been pursuing a stability-orientated policy and has not caved into the calls for a more expansionary policy from the side of the politicians. Instead, it has hiked interest rates by 75bp so far this year.

However, that still leaves real interest rate levels at unattractive levels. Should the price data surprise on the upside today this buffer would melt away even further. Despite current USDZAR levels around 14 we still feel comfortable with our year-end forecast of 15.20.

Long USDZAR in cash was stopped out, instead, open option spreads.

On the USDZAR front, we recommend positioning long USDZAR (ZAR has been significantly overshooting fundamentals), which makes buying USDZAR vol all the more appealing.

In naked vanilla form, we suggest call spreads at the 2M horizon, optimizing strikes for leverage. In USDZAR, the 1M-2M ATM spread is below average at +0.75, as 1M vols had remained relatively anchored and never softened significantly.

In order to ensure more than 50% discount to the outright vanilla, and a max payout/cost higher than 3.4:1, one needs to choose a combination of long 45D vs 25D. The call spread achieves a 55% discount to outright call and a max payout/cost ratio of 3.8:1 (mid values).

We believe our arguments still hold for a further ZAR weakness, but we acknowledge that the progress may be slower than we initially expected with anecdotal evidence suggesting positioning has been short ZAR. The lack of immediate negative headlines has led to a short squeeze in the currency.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence