One of the most visible effects of this year’s dollar weakness is the relentless narrowing of risk-reversals in USD pairs, particularly since mid-Q2 once the French elections were out of the way.

Initially, softer riskies simply reflected a lowering of European political tail risks, but skew compression accelerated from June onwards as investor demand for USD puts – especially fueled by the Euro surge –pushed vols higher and turned the usual positive spot-vol correlation in USD pairs on its head.

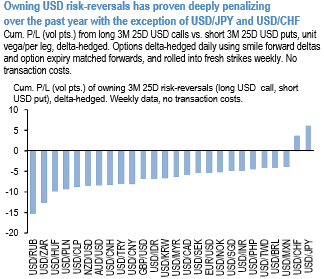

Unsurprisingly, returns from owning delta-hedged USD riskies have been deeply negative owing to a mix of this surface re-pricing but more crucially smile decay: the above chart shows that the scale of the P/L penalty from owning USD calls over the past year far exceeds moves in implied vols alone.

Only two currencies – JPY and CHF –managed to buck the trend of unprofitable USD call ownership, less due to favorable directional moves over this and more because of earning smile theta with riskies priced in favor of USD puts in both cases. USDJPY may be a questionable candidate in light of brewing political risks in Japan, but USDCHF (3M 25D RR -0.8, 1Y -1.1) can act as a carry-positive overlay on bullish Euro positions and/or a hedge against an unexpectedly potent tax reform developments out of Washington. Courtesy: JPM

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary