We expect three years of real GDP growth below 1% in 2018-2020, averaging 0.8% per annum, about a quarter of the world’s average growth rate. On a positive note, that ought to be enough to shrink the current account deficit to under 2½% GDP, but that’s a Pyrrhic victory. We expect the Bank of England’s MPC to keep rates on hold through 2018 and, ultimately, to be forced into further easing, against a backdrop of tighter policy elsewhere. All of which will anchor sterling.

On the flip side, Australia got a softer start to Q1 GDP accounting, Australia' trade deficit widened to AUD 0.63 billion in November of 2017 from a downwardly revised AUD 0.30 billion in the prior month and missing market expectations of an AUD 0.55 billion surplus.

China eases policy and commodities rebound;

The Australian housing market reaccelerates.

RBA left the cash rate unchanged at 1.5%, with post-meeting comments by Governor Lowe highlighting that the outlook for non-mining business has improved, but concerns remain around household consumption. Wage growth remains slow, while debt levels remain high.

Well, all these macros standpoints could propel GBPAUD either side but more downswings potential.

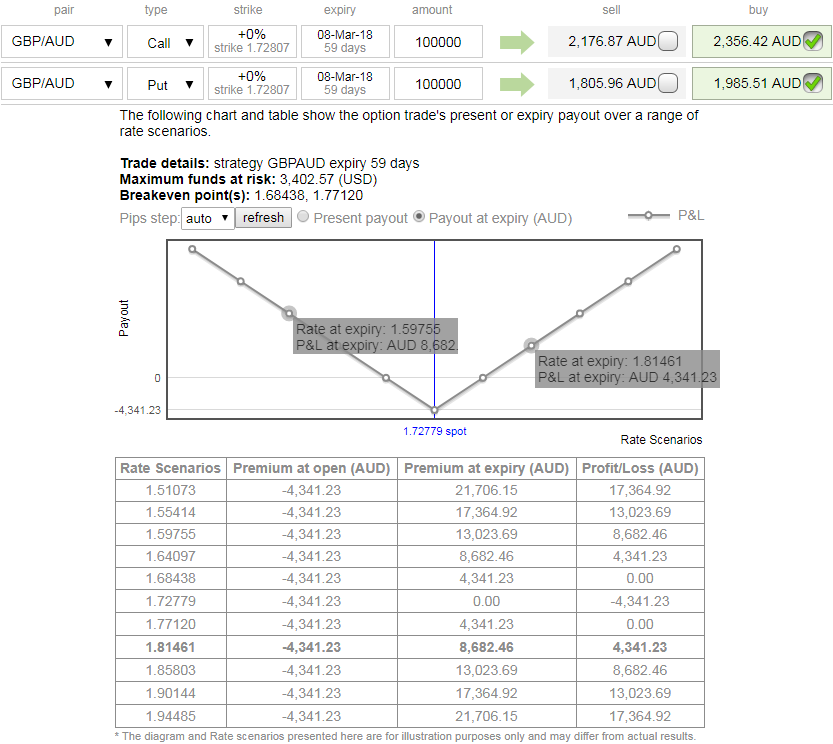

Consequently, in the prevailing puzzled environment, you could observe that the momentary bulls of GBPAUD struggle to break and sustain above stiff resistance of 1.7302-7310 levels, currently trading in non-directly to signal some bearish pressures. We advocate below hedging strategy with the cost-effectiveness that could hedge regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 2M at the money -0.49 delta put, long 2M at the money +0.51 delta call and simultaneously, short theta in 2w (1%) out of the money call with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

IV skews are well balanced on either side call and puts. The Vega of a short (sell) option position is negative and an increasing IV is bad. Please be noted that the 2w IVs are just shy above 6.6%, whereas OTM calls of this tenor have been crazily overpriced above 60% more than NPV, hence, we foresee writing such exorbitant calls are beneficial as there exists the disparity between IVs and option pricing.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into -10 (which is neutral), while hourly AUD spot index was at shy above -19 (mildly bearish) while articulating (at 12:48 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts