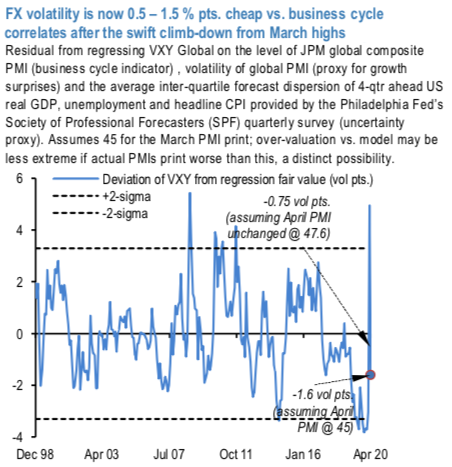

FX volatility, especially in G10, has spent most of April retracing from the manic highs of March as a plethora of Fed liquidity programs helped calm nerves in risk markets. But because the softening in vol has occurred alongside shockingly bad activity prints (European PMIs in the last week) and continued downgrade in global growth forecasts, there are now signs that this bearish reversal may have run too far: benchmarked against the level and variance of global manufacturing PMIs and macro forecast dispersion, VXY Global (9.6) screens 0.5 - 1.5 % pts too cheap depending on the projection of April Global PMI – for choice, probably the deeper of the two undershoots based on this week's G3 flash releases (refer 1st chart). It is not unreasonable to surmise that the Fed liquidity backstop may have trimmed the most disruptive of FX tails and hence the multi-sigma cyclical risk premium at the unhinged extremes of the GFC crash is perhaps not warranted this time around, but it is difficult to justify a risk discount in any asset class volatility in this growth climate (perhaps absent direct Fed purchases, but FX does not fit that description).

In addition to upside pressures on vol from the ongoing devastation in global growth, three factors are worth flagging as sources of potential spike risk -- the fallout of increased oil/commodity volatility, the rising political temperature in Europe, and the potential revival of US/China tensions. Higher commodity volatility is more impactful for commodity exporting EMs rather than G7 vols – a distinction exacerbated in the current instance by the ability of commodity exposed G10s like Australia and New Zealand to embark of QE on a scale that EMs will be hard-pressed to mimic - we are nevertheless still surprised by pockets of G7 resilience such as CAD that we would have expected ex-ante to react more forcefully to negative prompt WTI prices, and which we think are due a catch-up in coming weeks – perhaps if/when the kerfuffle around the May expiry WTI futures contract repeats next month; we buy USDCAD forward volatility this week through one-touch CAD put calendar spreads. Political risks around Europe and China both bear close watching from here.

On the former, owning EUR vol and/or risk-reversals has typically been a sub-optimal hedge against jitters in the European periphery in the past, so we are on the lookout for better value, higher-beta vol expressions over and above directional exposure already in the macro trades portfolio.

We do, however, buy some CNH forward vol this week to hedge against any abrupt deterioration in US/China relations that turns CNY-stability on its head. Given unchallenging vol levels today, no one should be surprised if some combination of these economic and political tails delivers the risk-unfriendly outcomes May is notorious for. Courtesy: JPM

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges