The Bank of England has upheld its monetary policy stance unchanged, standing pat on the official Bank Rate at 0.5% and the APF at £375bn.

More importantly, the split of the vote for the bank rate decision has changed. As expected, Ian Mc Cafferty has opted not to vote for a rate hike, after six months of voting for one, leaving the split at 9-0 in favour of the status quo (previously 8-1). The last time Mr Mc Cafferty withdrew his vote for a hike was in January 2015 (alongside Martin Weale), after having voted five times for one.

On the flip side, After the ECB eased by less than expected in early December, the SNB also held off from easing.

It still threatens to do more if necessary but shows a reluctance to deliver on that threat - i.e. the SNB does not seem likely to cut rates further in an attempt to push EUR/CHF higher, rather it may use its remaining policy tools (further cuts and/or actual intervention) to prevent EUR/CHF from trading much lower.

Expectations for the SNB also unwound after the ECB disappointment so when the unchanged decision came on December 10, it was much as expected.

While on the technical perspectives, both EOD and weekly technicals raises a caution for ongoing short term upswings as the rising prices do not evidence corresponding volumes and stuffs there was a sense of convergence evidenced on RSI and Slow Stochs curve to the dipping prices. Both daily and weekly stochastic oscillator signal selling momentum in overbought zone, for more reading follow the below link.

http://www.econotimes.com/FxWirePro-Cover-GBP-CHF-longs-before-getting-stuck-in-blood-bath-gravestone-at-14660-to-reject-resistance-binary-puts-to-speculate-155723

To summarize in brief, central banks on both sides maintaining policy stances according to the domestic and macroeconomic situation which could be deemed as a dovish measure to deal with it.

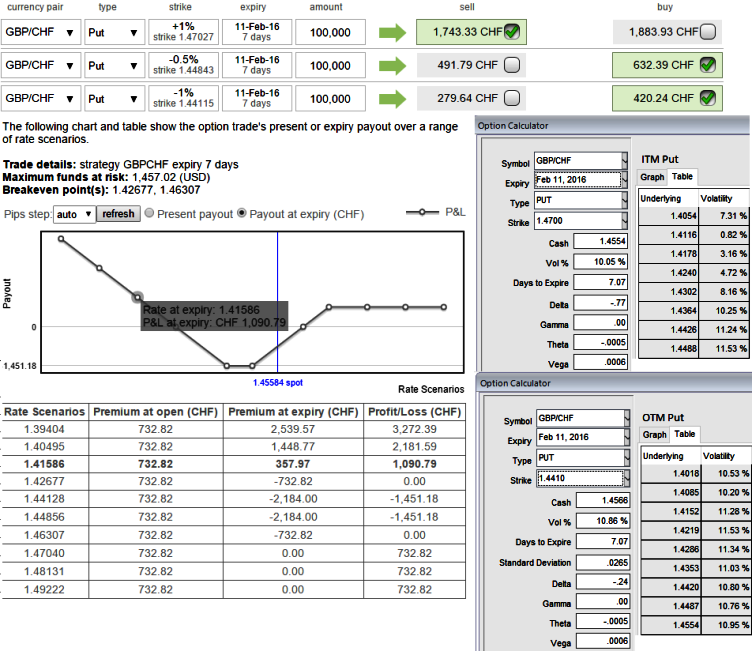

Hedging Strategy: Put Ratio Back Spreads (GBP/CHF)

So, we think arresting potential downside risks of this pair is possible by hedging through Put Ratio back Spread and as it is reckoned that the underlying currency GBPCHF to make a large move on the downside.

We recommend holding longs on 2 lots of 2W out of the money (one 0.5% OTM -0.37 delta put and one 1% deep OTM -0.29 delta put) that would function effectively in declining swings in the days to come. And simultaneously go short on 1W 1 lot of (1%) ITM -0.77 delta put option would finance the hedging cost as it assures returns in the form of initial premium receipts if it remains sideways or rallies a bit, longs on OTM puts are certain that would take care of potential downswings.

With these narrow strike differences, the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement. You want to take this trade if you think this pair can go lower, but not crash below 1.4484 (the OTM shorts) in next one week is also harmless. Caution: If you think the pair is going to crash, you should be loading up on put buys in existing strategy.

Since the option you sell will always be lower on the skew curve it means you are getting a better deal on what you are selling compared to what you are buying. It makes this strategy a good one if the skew is running a little hot but GBPCHF hasn't rolled over that much.

FxWirePro: Stay hedged in GBP/CHF via PRBS to reduce hedging cost on monetary policy risks between UK and Swiss central banks

Thursday, February 4, 2016 1:54 PM UTC

Editor's Picks

- Market Data

Most Popular

2

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks