Swiss has still been the country to have one of the least inflation rates in world. It came in at -1.3% (YoY) in January of 2016 for the second consecutive month, in line with market expectations. The inflation rate remained in negative territory for the fifteenth straight month as lower oil prices keep dragging transport and energy cost down. The CPI (MoM) in Switzerland printed 0.4% in January of 2016.

While, unemployment Rate in Switzerland increased to 3.8% in January from 3.7% in December of 2015.

Since USDCHF stepped up into a higher range in January 2016 series, Feb series has been reluctant, while EUR/CHF has crawled up that was stuck trading around 1.07/1.10 range. That still leaves USD/CHF determined by EUR/USD.

After the ECB eased by less than expected in early December, the SNB also held off from easing. It still threatens to do more if necessary but shows a reluctance to deliver on the back of inflationary pressures.

The SNB does not seem likely to cut rates further in an attempt to push EUR/CHF higher, rather it may use its remaining policy tools (further cuts and/or actual intervention) to prevent EUR/CHF from trading much lower. Expectations for the SNB also unwound after the ECB disappointment so when the unchanged decision came on December 10, it was much as expected.

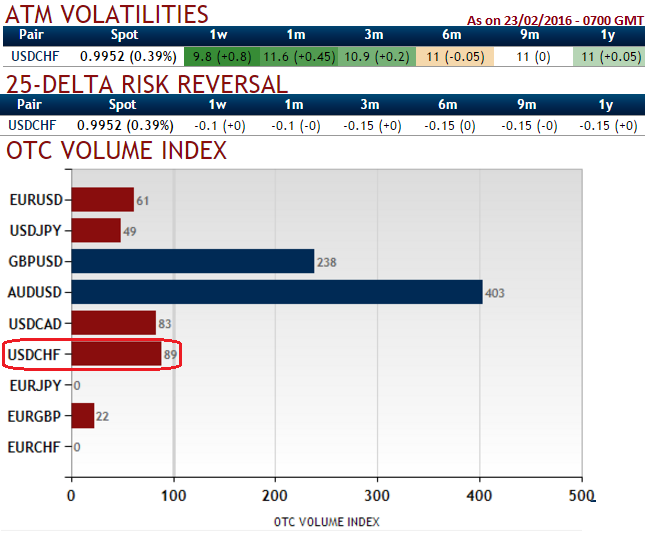

USD/CHF ATM IVs are dramatically spiked up over 11.5% for contracts of 1M expiries, while risk reversals have been lackluster but reduced the hedging volumes for bearish risks. Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Hedging strategy:

Contemplating the IVs movements and capitalizing on rising IVs but certainly not solely relying on risk reversals we would like to construct straddle strap strategy so as to hedge this pair for FX uncertainty.

Spread ratio: (Buy 1: Buy 1: Buy 1: Buy 1)

Call Strip Construction: Go long in 1M at the money call with +0.51deltas, Go long in 2M at the money call with +0.48 deltas, simultaneously go long in near month at the money put with -0.49 deltas.

FxWirePro: Swiss inflation "a cause of concern" for SNB - deploy USD/CHF vertical straps on spiking IVs but stagnant risk reversals

Tuesday, February 23, 2016 11:36 AM UTC

Editor's Picks

- Market Data

Most Popular

6

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary