Turkish lira against the US dollar and euro has been dipping constantly owing to various fundamental driving forces that are discussed extensively in this write-up. While spot FX prices of USDTRY and EURTRY have been spiking to hit a fresh all-time highs of 4.0659 and 4.9762 levels respectively.

About a month ago, we added to our bearish TRY positions as a hedge to rising core yields with a deteriorating current account balance adding challenges to the lira outlook. While USDTRY has flat-lined since the start of the year, the lira remains vulnerable to a move higher in US real yields. This is as domestically real yields are still too low to sustainably bring down inflation, while funding the current account deficit requires positive risk appetite to support portfolio inflows.

The lira was already on a losing streak through March, and yesterday reached a new record low of 4.50 (against an equally weighted basket of EUR and USD). We can discuss what the exact trigger was – our view has been that one or other development could appear to be decisive on a given day, but the currency would probably have behaved similarly regardless – high inflation and lira depreciation are now in a spiral.

Nevertheless, at an already tricky juncture, local media reported that Deputy PM Mehmet Simsek had handed in his resignation – this was in response to President Tayyip Erdogan criticising the economic management team (which Simsek heads) for not ensuring lower interest rates; it was reported that PM Binali Yildirim somehow prevented the resignation.

This story has relevance to the extent that such developments would further impair CBT's ability to break the inflation FX spiral using higher rates. We do forecast rate hikes by the CBT going forward, but in the absence of this, the downside for the lira would be much steeper.

Overall, the Turkish lira tried hard to be more stable recently, and therefore the tendency for inflation would be to peak and moderate – but only slightly, say to around 9% in the coming months. This extent of moderation will not neutralize Turkey’s long-term inflation, though – at best, it can bring near-term relief. In the medium-term term, we, therefore, expect USDTRY to head up towards the 4.00 mark.

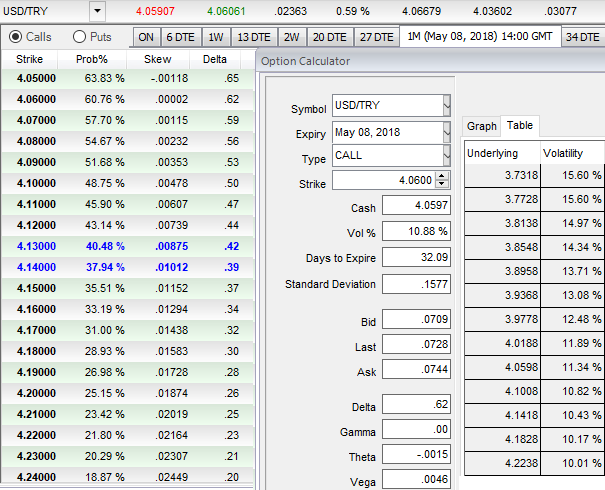

As we could see 1m IVs have been positively skewed towards OTM calls with attractive IVs at 10.88%.

Trading tips:

Sold 1Yx1Y USDTRY FVA vs longs in 1Y ATM call.

Bought USDTRY call (at 4.00) and also EURTRY call (at 4.83) (equal weighted USD notional), we continue to roll on the positions or uphold the same positions of having decent deltas with near-month tenors as shown in the above diagram.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential