Last week, the trade protectionism theme shot back into focus as a potential major left tail risk for markets which got further aggravated by the subsequent retaliatory rhetoric from Europe and Asia.

President Trump has followed through on his promise to impose tariffs on steel and aluminum imports but alleviated the worst of the retaliation fears by excluding Canada and Mexico and leaving the door open for other US trade partners to be given similar exemptions.

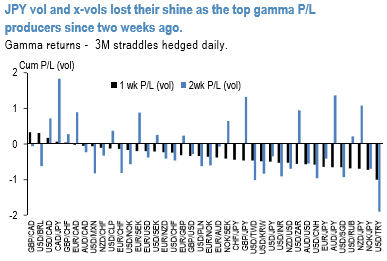

With risk on-risk off flip-flopping throughout the week gamma returns under delivered (refer above chart).Yet, residual risk remains of broadening tariffs, reprisals from trade partners and a disruptive finding of the China/intellectual property Section 301 probe.

JPY somewhat underperformed with USD amid firm risk sentiments until early February, and then turned to outperformer, triggered by a plunge in global stocks. On net, as the latter was more dominant, JPY became the outperformer within the G10 camp during the relevant period.

FX forecasts for all G10 majors were upgraded vs. USD intra-month. EUR/USD year-end put at 1.29 (prior 1.23). USD/JPY year-end at 108 (prior 112). On a tactical basis, we have reduced USD shorts, are still long euro, and have become long CHF and JPY as hedges.

In our model portfolio, we already carry long cross-JPY Vega in spread format (GBPJPY – USDJPY, BRLJPY – USDBRL), long EURUSD and EUR-cross (EURCAD) vol exposure and are short high dollar correlations (NZD vs. JPY) that should mean-revert lower if trade skirmishes intensify.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures