On the eve of Bank of England’s monetary policy today, let’s begin by recalling as to how the UK central bank confused the markets in previous MPS. There was the widespread surprise when the MPC chose to leave rates unchanged in the last monetary policy meeting.

For now, there is no reason in pretending otherwise: the Brexit vote would be a hard blow for the UK economy in the months to come. Although the economy developed in Q2, the collapse in Q3 and forward guidance has been very painful.

The PMI in the UK has provided a first taster. Manufacturing sector eased significantly from 55.5 points in the previous month to the current 54.3 points; the final estimate now resulted in a real collapse (consensus 54.6). The PMI for the construction sector managed to produce upbeat flashes at 52.6 versus consensus at 51.9 and previous prints at 52.3, where service PMIs would be announced today but had collapsed from 52.9 to 52.6 in October and points in the same direction.

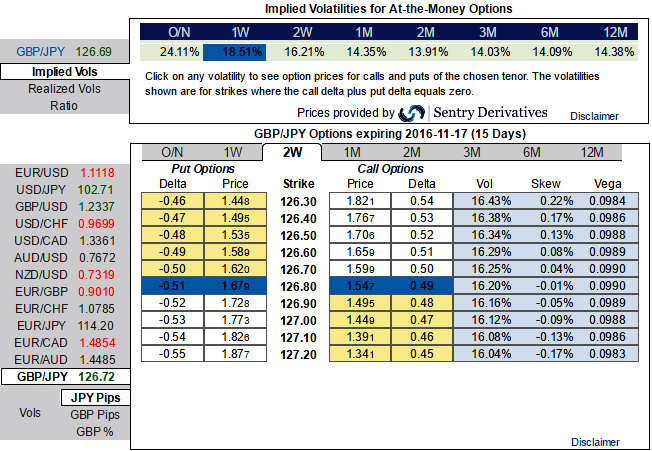

Please be noted that GBPJPY skew is not ready to smoothen too much ahead of central banks inflation report and monetary policy, the GBP volatility in 1-3m tenors normalized considerably.

The liquidity recovered and the extreme positioning was ultimately absorbed. The price action is not taking the direction of an imminent new trend. As a result, the option market aggressively unwound smile positions.

In our recent hedging portfolios we had advocated ITM put shorts when underlying FX price was at 127.35 levels, now you could probably guess that from the spot FX of GBPJPY, the yields from these shorts are certain by now.

Negatively skewed GBPJPY 1w IVs for now signify the interests of ATM put holders and their competitive edge in PRBS as an optimal hedge, consequently, we uphold -0.49 delta ATM puts.

Please be noted that the 1m GBPJPY IV skews are more biased towards OTM put strikes.

From the IV nutshell, one can understand that the negatively skewed IVs in 1m contracts would imply that the underlying spot FX is less likely to remain in ITM territory or in other words spot FX would shift towards OTM strikes.

There was also a valuation issue at play, in that yen, vols had lagged the sharp collapse in VXY prior to BoJ –held up in all likelihood by the outside chance of a policy regime shift in Japan –and were ripe for a sell-off if the meeting proved uneventful.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed