Yesterday, WTI crude prices have edged higher above $70 mark, as API data showed higher-than-expected 9.2 million barrel drop in the US crude stockpiles in the week to June 22 to 421.4 million barrels. The energy prices sustained above $70 levels and dragged the rallies today above $71 areas on US-Iran tensions.

We see an increased risk that a broad consolidation for Crude can develop into Q3 after hitting our medium-term targets as the US authorities expect every country to cut all oil imports from Iran to zero by Nov. 4 or risk sanctions, a U.S. official said.

Thereby, it seems that Trump’s administration is showing less patience. The official stressed that companies based in China and India, two of the largest buyers of Iranian oil, “will be subject to the same sanctions that everybody else is” if they continue with the purchases.

Moreover, technically we note that WTI confirmed a bearish reversal month with the May close below the April close. WTI sees important support at the 61-59/bbl area; Brent leans a bit more bullish, but risks are increasing as the 74-72/bbl area will define whether the uptrend shifts into a consolidation phase.

We reiterate focus now on EIA crude stockpiles data announcement which due in the US trading sessions for further impetus and we run you through the most thrifty expression of option structure that takes advantage of the two distortions is a short Jun'19 OTM 30D-35D strike (strike $70/bbl) put vs long Jun'20 ATMF straddle (strike $69.25/bbl) vega-neutral calendar spread (all legs delta-hedged, notional ratio 150 lots of the put vs 50 lots/leg of the straddle).

The net structure is theta-earning by construction, but with the cover of a vega hedge behind the short leg that dramatically improves the risk-reward of naked vol selling.

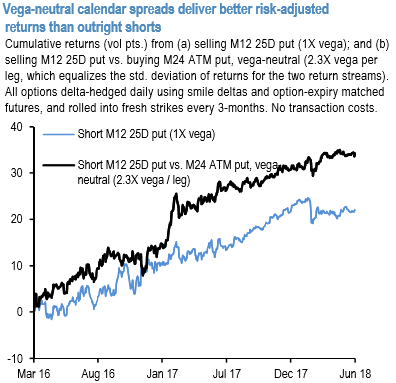

The above chart illustrates return streams from an outright M12 put and the same put hedged vega-neutrally with a M24 ATM option: the improvement in risk-adjusted returns is palpable, with Sharpe ratios rising from 1.0 to 1.6, and average annual return /max drawdown ratio jumping from 1.4 to 2.4 over the sample period (not inclusive of transaction costs). Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary