It seems that the OPEC countries did decide on a cut in production at their informal meeting in Algiers in a surprise move. The details will only be worked out in time for the next official meeting in November. The prospect of rising oil prices supported CAD and NOK. However, we urge caution: a deal will have to be reached first! So please hold back on the euphoria.

This one story and on the flip side, just as the market was craving any clear-cut statement on the Fed’s future interest rate policy in the run-up to the last FOMC meeting it is now steadfastly ignoring any comments by Fed members, regardless of how clearly they are staking out a rate rise in December.

Any rate hikes by the Fed or any hawkish statements are viewed as bearish for CAD, which struggles to compete with high-yield bearing assets in rising rate environments. USDCAD was almost unchanged at 1.3165.

Sentiment on the commodity currencies remained fragile depending on whether crude price patterns in consolidation mode to continue or bounces back going forward, as global supply glut concerns overshadowed has now come into an agreement among exporters to freeze output.

OTC outlook:

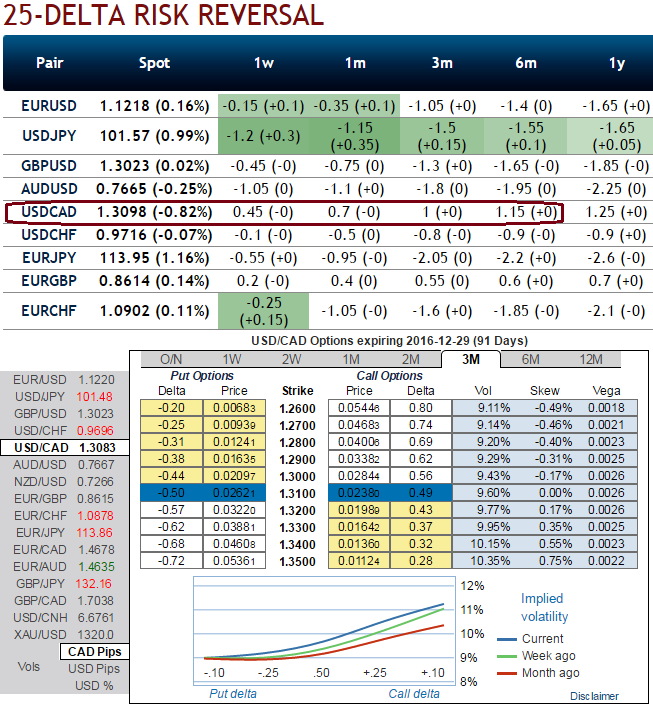

We think above fundamentals seem to be addressed by hedging participants, as you can observe the risk reversal flashes for 1 and 3 months tenors, CAD seems to be gaining in next 1 months tenor on recent OPEC’s announcements, whereas dollar is also likely to risk in 3m tenor, i.e on eve of Christmas where Fed’s chances of hiking can’t be disregarded.

Mounting positive skews in 3m implied volatilities suggests RKO calls on speculative grounds, the USDCAD 2-3m skew has been bid with Trump progresses in the polls, lifting it to its highest level since June 2015.

Option strategy:

Strategy: 3-Way Diagonal Straddle versus OTM Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Let’s glance on sensitivity tool for 3m IV skews would signify the interests of OTM call strikes that means the ATM calls higher likelihood of expiring in-the-money.

The execution:

Go long in USDCAD 1M at the money -0.49 delta put, and go long 3M at the money +0.51 delta call and simultaneously, Short 2W (1%) out of the money call with positive theta.

Favour optionality to directional trades. We are inclined to position for a partial retracement of the down move through call spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment. For speculators, call spreads are preferred to vanilla structures given elevated skew and favourable cost reduction.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch