FX vols have almost entirely retraced their peak-to-trough jump as the VIX spike of early February has subsided, but are entering March with a renewed bid under the cloud of trade tensions. Aside from the yen for which the direction of travel is clearer than elsewhere, most other USD pairs are subject to cross-currents of US twin deficits, a potentially more-hawkish-than-expected Fed, and negative trade-related headlines, hence it is unclear whether options will receive enough directional sponsorship from an unambiguous dollar trend to send implied vols spiralling higher as happened in January.

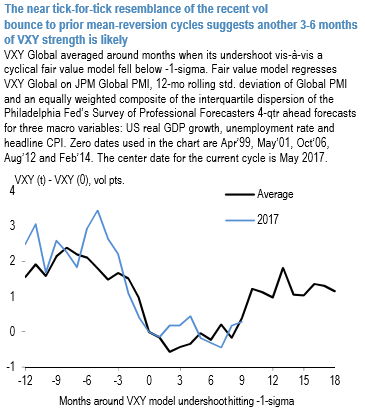

At the same time, a choppy range in the dollar should arrest the decline in realized volatility following the VIX shock, and VXY should remain in the ascendant track of its typical recovery pattern from cyclical troughs for the next 3-6 months (refer above chart). Net-net, the bar for vol selling is high in this climate, but we are not averse to selective RV constructs that take advantage of the cheapness of EUR/high-beta cross vols.

We also favor positioning for a muted dollar environment via soft short USD-correlation structures such as vanilla USD-JPY-NZD correlation triangles that net collects premium but with the hedge protection of a high-beta cross-yen leg. Given the historical precedent of de-coupling between reserve and commodity/carry currencies during trade conflicts.

Owning select EUR-and JPY cross vols that benefit from such a wedge is perhaps the cleanest theme at present; we are already positioned for this through GBPJPY – USDJPY and BRLJPY – USDJPY vega spreads, and add a soft, net premium-earning version of the same through a correlation triplet.

A more muted dollar environment should also tilt USD-correlations lower. Express a soft bearish USD corr lean via option triangles that sell USDJPY and NZDUSD puts hedged with long NZDJPY puts.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch