Stay long EURNZD, as the kiwi dollar has been relatively resilient this week as New Zealand was one of only two G10 currencies where interest rates increased this week.

The outperformance came on the back of a lower than expected unemployment rate print (but notably no wage pressures) and despite a 6% drop in milk prices just over the past week, which represent the largest 1-week decline in eight months (GDT index prints at 11.4% versus previous 1.4%).

As a result of these moves, NZD has gone under pressure owing to the recent RBNZ’s easing of 25 bps to keep OCR at 1.75% in the recent monetary policy meeting, we see this as at the extremely rich valuations not just relative to its own history but also relative to other pairs (NZDUSD is the richest dollar pair in our short-term fair value models).

By our estimates, NZDUSD is nearly 7.5% (or 2.3 sigma) too high adjusted for milk prices, volatility and rate differentials, which is the third highest in three years.

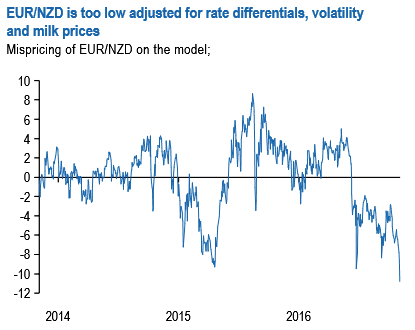

Similarly, EURNZD is around 10% (or 3.1 sigma; note that the standard error of this framework is quite high) too low adjusted for similar factors which is even a larger mispricing than following the ECB's QE program was first announced in the beginning of 2015 (see above chart).

Option Strategy:

1m ATM IVs are spiking even after above stated economic events, but remain at a tad below 13%. This is a good news for option holders.

The debit call spreads are preferred over vanilla structures given elevated skew and favorable cost reduction.

Buy EURNZD 1W25D call spread with strikes of 1.52 - 1.5010 – for a net debit.

The net delta of the position should be at around 61% and selling the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%.

The Black-Scholes IV curve is asymmetric in the overall sample, displaying a rising pattern with moneyness, and 1W and 1M risk reversals signaling the sharp upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Maximum gain is achievable when underlying spot FX move above OTM strike after 1 week with ideal risk-reward.

By shorting the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays