The RBNZ said it has ended its easing cycle and will remain on hold until 2020. That will anchor the short end, although markets will not abandon their expectations for earlier tightening which means occasional spikes in the 2yr will be likely.

The long end will continue to follow mainly US yields, which we expect to rise. That means the curve steepening trend should continue.

Granted, the NZ economy is strong and dairy prices have risen, but these forces are subservient to the US dollar’s trend. Better data, but falling real rates and tightening credit keep us bearish.

We expect NZD to fall through this year, reaching 0.62 at year-end. The support to growth from migration will fade, while the RBNZ -at the very least–are likely to hold rates steady as inflation normalizes, pushing real rates materially lower.

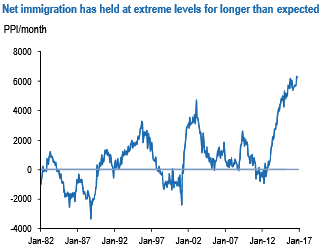

Since our NZD outlook piece in November 2016, the economy has continued to perform strongly in real terms. GDP growth was over 1% QoQ in Q3, which would see the economy rounding out the year with annual growth comfortably above 3%. Still, much of the upside surprise in activity indicators is owed to the positive supply shock from migration (see above chart).

We expect that growth impulse to fade through 2017, which would deliver growth performance more in keeping with subdued inflation, and would also remove some of the pressure on housing.

It is even easier for the RBNZ to maintain a low for long bias in an environment where spreads are widening, and delivered mortgage rates are rising. We believe the overvalued exchange rate is preventing sufficient capital inflow to the non-bank economy to compensate for a swelling current account deficit. This has resulted in leakage of NZD liquidity, and rising funding costs for the bank.

The economy is also now subject to credit tightening through numerous channels: macro-prudential constraints, widening mortgage rate spreads, and banks’ discretionary tightening of credit criteria to businesses. We now expect the RBNZ to be on hold this year, but there is a clear downside risk to the OCR in the near term.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January