AUDUSD medium-term perspectives: The ongoing structural Chinese slowdown is expected to remain orderly, which should provide reasonable support to Australia’s commodity exports. Our commodity strategists see iron ore prices supported above $60/t in 2018, but coking coal prices to decline. There are thus downside risks to the AUD from these factors.

Over the course of Q1’18, we look for AUDUSD to return to the 0.75 area seen in early Dec 2017. This should occur if interest rate markets move closer to Westpac’s view of no change in the RBA cash rate this year and if the prospect of increased supply cools the recent commodity price rally. But a firmer US dollar is probably necessary to get as far as 0.75.

AUD is a strong USD-hedge candidate since one-touch AUD put pricing benefits from wafer thin forward points and risk-reversals that renders negative carry of AUD selling almost negligible, and the underlying itself provides fundamental diversification for the broad reflation theme given Australia’s unique domestic headwinds, as well as useful equity beta should the breakneck rally in stocks hit a roadblock.

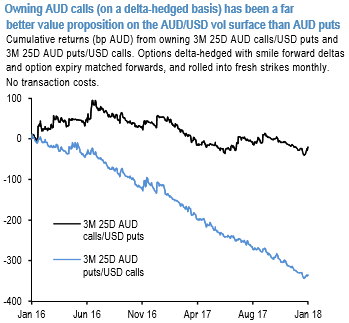

That AUD is worth selling via options does not necessarily imply we find AUD risk-reversals “cheap” enough to warrant owning vanilla AUD puts outright – indeed, recent spot-vol correlation in AUDUSD has been sharply positive (spot up, vol up) in defiance of the persistent bid for AUD puts on riskies, indicating much better value in owning AUD calls rather than puts on the surface (refer above chart).

In light of this, the reduced risk-reversal sensitivity of one-touches is preferable to vanillas while still retaining healthy mark-to-market P/L sensitivity to spot moves. Off spot ref. 0.8035, consider 2M 0.77 strike AUD put/USD call one-touches for 20.7% indicatively.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields