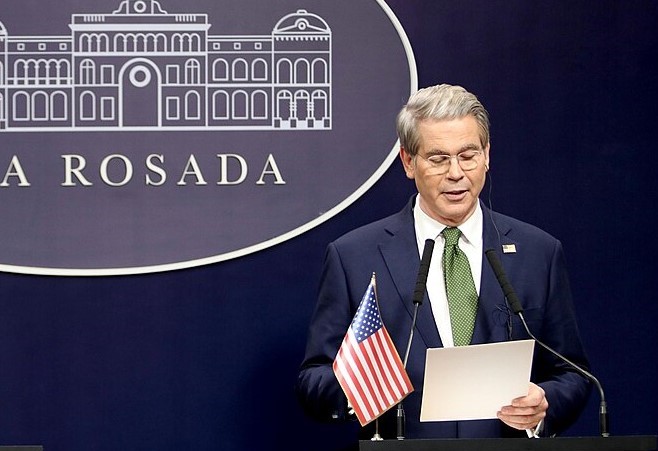

The upcoming G20 finance chiefs meeting in Durban faces growing uncertainty amid escalating global tensions. U.S. Treasury Secretary Scott Bessent’s second consecutive absence raises concerns about Washington’s commitment to global economic cooperation. Analysts say the U.S. no-show, paired with Donald Trump’s aggressive tariff agenda, threatens the G20’s credibility and effectiveness.

Trump’s trade strategy now includes a blanket 10% tariff on all imports, with targeted duties—50% on steel and aluminum, 25% on autos, and up to 200% on pharmaceuticals. Additional tariffs on 25 countries, many of them BRICS members, are set to take effect August 1. With eight G20 countries now part of BRICS, including South Africa, geopolitical divisions are sharpening.

Experts warn that Bessent’s absence may signal the U.S. shift toward a stripped-down G20 model during its presidency next year. “It’s problematic not to have the world’s largest economy at the table,” said Josh Lipsky of the Atlantic Council, noting the implications for global economic stability.

Meanwhile, Africa’s debt crisis looms large. Sub-Saharan Africa’s external debt has surged to $800 billion—45% of regional GDP. Chinese lending has slowed, creating an $80 billion financing gap. Former South African finance minister Trevor Manuel emphasized the need for transparency in loan terms, especially regarding China’s Belt and Road Initiative.

Adding to the pressure, U.S. and European aid cuts threaten 25% of the region’s external financing. Political analyst Lumkile Mondi warned that Africa’s high debt and low growth may deter future investment.

South Africa, under its G20 presidency motto “Solidarity, Equality, Sustainability,” had hoped to focus on climate finance and North-South trust. But ongoing trade disputes and aid rollbacks now dominate the agenda, dampening hopes for consensus.

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans

TrumpRx.gov Highlights GLP-1 Drug Discounts but Offers Limited Savings for Most Americans