The law of economics dictates that when demand is high and supply is low, prices go up. This is essentially the reason why graphics cards have become unbearably expensive, to the frustration of PC gamers. A lot of the blame regarding this trend is being leveled at cryptocurrency miners. However, it seems smartphone giants like Apple and Samsung are guilty of contributing to the problem, as well.

According to some retailers, the trend of rising GPU prices is not likely to come down anytime soon, Hot Hardware reports. As expected, a lot of this has to do with the supply not meeting the current demands, which is especially galling to gamers since they believe that they are supposed to be the primary consumers of GPUs.

Unfortunately, no relief can be expected over the coming months, with the soonest probable break being Q3. Even then, there is no guarantee that this is going to be the case since it would depend on a lot of factors.

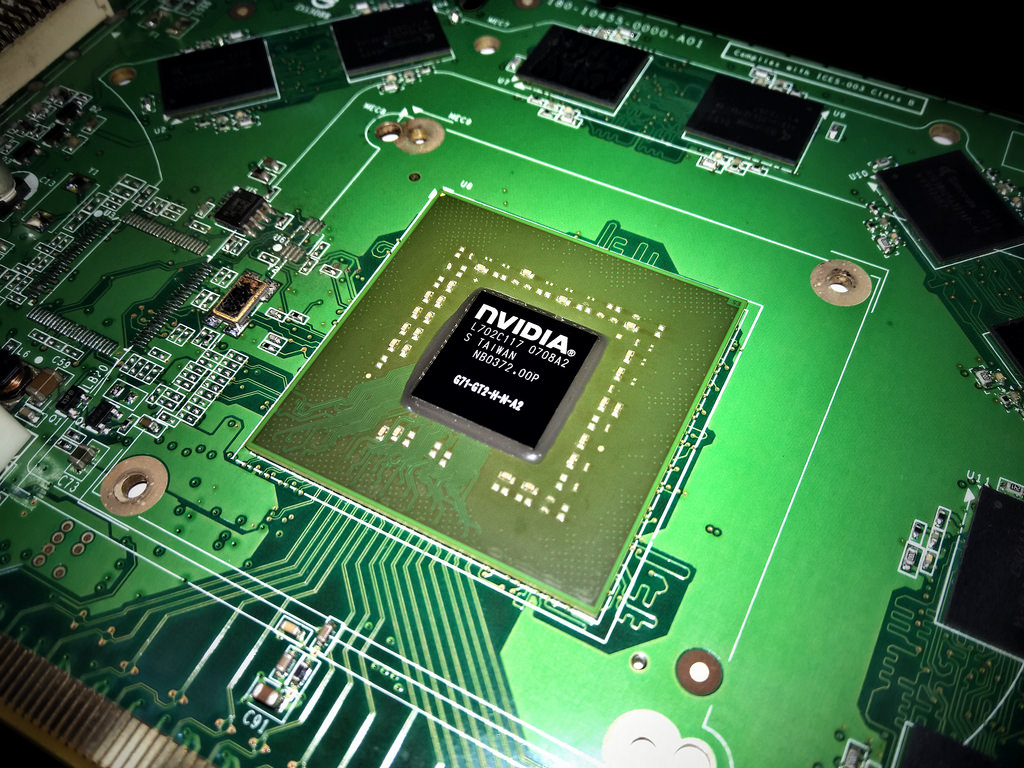

Cryptocurrency miners are currently bearing the brunt of the blame for the shortage in supplies of GPUs. Depending on how the crypto market goes, this could get progressively worse if companies like Nvidia are unable to keep up even with increased production.

Then there’s the matter of smartphone companies using the memory components as those found in GPUs, making production even more problematic. Tech giants like Apple and Samsung are willing to pay top dollar to corner the market as much as they can in order for them to keep producing more mobile devices.

While it might be hard to hear, it’s a simple fact that there is more money to be made from smartphone companies and crypto miners than there is from gamers right now. As such, it’s no wonder that priorities would be directed at where the grass is greener.

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links