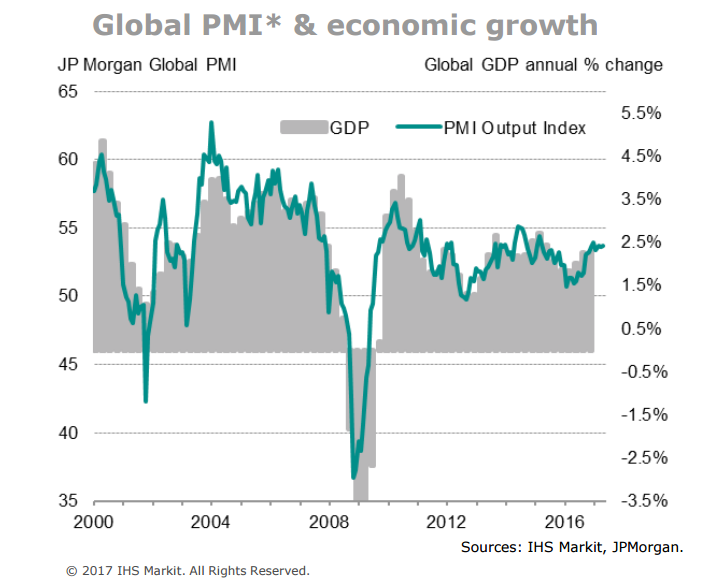

According to PMI survey data compiled by IHS Markit, JPMorgan Global PMI edged higher to 53.7 in May from 53.6 in the previous month. Both the emerging markets and the developed world signalled robust rates of economic growth. While the Emerging Market PMI rose to 52.2 in May, the second highest in 32 months, the Developed World PMI held steady at 54.3.

Growth in the developed world economies was led by Europe, followed by the UK. Relatively robust expansions were meanwhile seen in the US and Japan with both reporting faster rates of growth than April. The biggest disappointment was the on-going meagre growth rate signalled by the Caixin PMI surveys for China, where manufacturing even slid back into decline.

Data suggested that the global economy is on track for a robust second quarter, with the latest reading being broadly consistent with global GDP growing at an annual rate of 2.5 percent. That said, global PMI surveys highlighted the challenges of low cost pressures as shown by the smallest rise in worldwide factory input prices since last September. Data suggested that lower cost pressures could also feed through to consumer prices as retailers see pressure come off wholesale prices.

As political uncertainties rise across Europe, risk for sustainable growth rises. The broader mood in the market appears cautiously positive. A 25bps cut by the Fed is more or less fully priced in at this point, but the future path still represents a potential risk for the USD as investors are clearly skeptical that policy makers can deliver further tightening as focus turns to the balance sheet reduction process and weak inflationary pressures persist. And with an inconclusive election result in the UK, focus turns to Brexit negotiations which have the potential to dent prospects for UK economy.

Forex markets remained volatile on the day. GBP slumped in wake of UK election result. USD was trading firmer, up 0.7 percent on the week, extending gains for a third day. EUR broke below 1.12 against the USD as the European Central Bank (ECB) shows little risk of immediate policy change. JPY was under steady pressure with focus on the Bank of Japan (BoJ) policy meet next week.

FxWirePro's Hourly Currency Strength Index at 1200 GMT was as follows: USD Spot Index: 76.7096 (Nuetral), JPY Spot Index: -30.7466 (Nuetral), GBP Spot Index: -118.237 (Bearish), EUR Spot Index: -25.7756 (Nuetral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal