Gold holds above $2900 on tariff threat. It hit a low of $2877 and is currently trading around $2911.73.

Gold's Ascent: Tariff Threats and Safe-Haven Appeal

On February 18, 2025, gold prices went up on safe-haven demand after increased concerns of President Trump's tariff policy and potential global trade wars. Spot gold rose by 0.2% to $2,903.56 an ounce, and U.S. gold futures went up by 0.6% to $2,916.80 an ounce.

Analysts Perspectives: Factors Driving Gold Prices

Analysts attribute the price increase to uncertainty in trade policy, which makes investors seek refuge in gold. Kyle Rodda of Capital.com attributed it to central bank buying and European shortages, while Rahul Kalantri of Mehta Equities attributed it to the gold trading range against a weak dollar index.

Tariff tensions and geopolitical risk have underpinned gold prices, with Goldman Sachs forecasting a price of 3,100 per ounce by year-end 2025, citing central bank purchases.

Rate Pause Sentiments Climb

According to the CME Fed Watch tool, the chances of a rate pause on the Mar 19th, 2025 meeting have increased to 97.50% up from 95% a week ago.

Technical Analysis: Key Levels and Trading Strategy

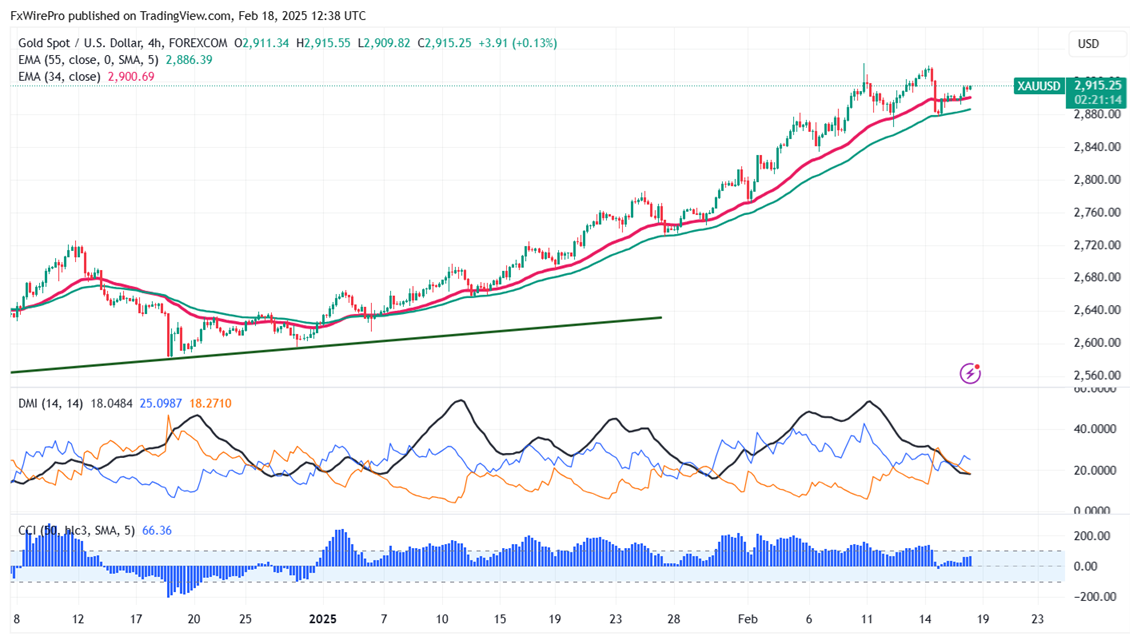

Gold prices are holding above short-term moving averages of 34 EMA and 55 EMA and long-term moving averages (200 EMA) in the 4-hour chart. Immediate support is at $2875 and a break below this level will drag the yellow metal to $2860/$2850/$2830/$2800/$2770/$2740. The near-term resistance is at $2920, with potential price targets at $2945/$2957/$3000.

It is good to buy on dips around $2850 with a stop-loss at $2830 for a target price of $2955.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings