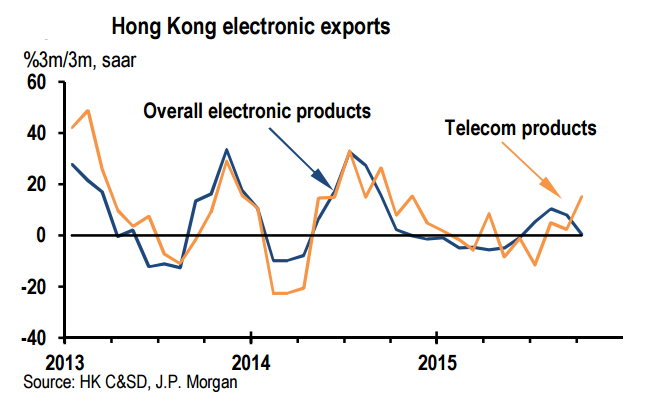

Hong Kong's total exports rose 1.1%m/m, sa in October, leaving total exports down 3.7%oya. Meanwhile imports slipped 0.1%m/m, sa, falling 8.5%oya in October. As a result, the trade deficit narrowed to HK$29.6 billion in October from HK35.2.1 billion in September. Exports of telecom products surged 8.8%m/m, sa in October while overall electronics only gained 0.3%, hinting that the tech cycle may still be alive, but narrowly based around the new mobile phone launches in 3Q.

The risk is that unless the tech strength broadens out, the cycle may be short lived and may not benefit the region uniformly. Indeed, coinciding with the surge in telecom products, exports to Taiwan also jumped 11.7%m/m, sa in October, reflecting Taiwan's position as the tech bellwether for the region and one of the main beneficiaries of the current cycle. Meanwhile exports to other major destinations remained soft in October.

By region, exports the G-3 countries remain choppy, and still await a lift from improving growth momentum in developed markets. Meanwhile, developments in China still remain cloudy. While China's growth is expected to slow next year, in the near term, some rotation is expected in China's growth drivers, with a modest pick up in good-producing activity and a slowdown in the service sector growth in the next 1-2 quarters. If indeed this rotation materializes, it will provide a cushion for Hong Kong's re-export activity.

Hong Kong’s exports stronger than expected in October, telecom exports surge

Tuesday, December 1, 2015 11:08 PM UTC

Editor's Picks

- Market Data

Most Popular

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal