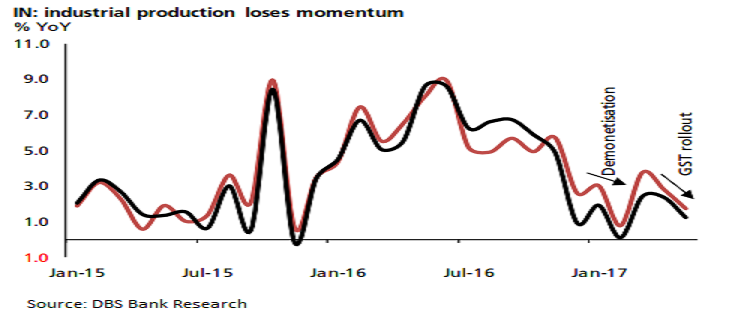

Wrapping up this otherwise light data week is the June industrial production (IP) numbers, due tomorrow. Factory output likely lost momentum for the fourth consecutive month into June. The heavyweight manufacturing output likely retreated ahead of the GST rollout in July.

Firms were cutting back on inventories, putting new orders on hold and clearing existing stocks on discounts. June core industries index, making up 40% of the overall IP output, also slowed to 0.4 percent from 4 percent month before. Electricity generation eased notably, whilst mining likely stabilized.

Another lead indicator, June manufacturing PMIs had also softened, with July’s reading slipping into contraction. The survey respondents highlighted a fall in input purchases, lowering the stock of raw materials and semi-finished items. New domestic orders moderated while those for exports remained upbeat. Business outlook sub-indices remain positive, boding well for forward-looking trends. This points to transient softness in production trends, which could pass by the final quarter of the year, helped also by festive spending.

Consumer durables’ trends are likely to be watched closely as re-monetization runs its course and improving rural wage growth along with higher public sector allowances are expected to underpin consumption. Higher public capex picks the slack from weaker private investment interests. For now, production trends remain sobering with Jan-May up 2.4 percent slower than 2016’s 5.8 percent.

"We expect a 0.5 percent y/y drop, from 1.7 percent month before. This could take Q2 2017 IP to 1.5 percent, from Q1’s 2.5 percent," DBS Bank commented in its latest research report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility