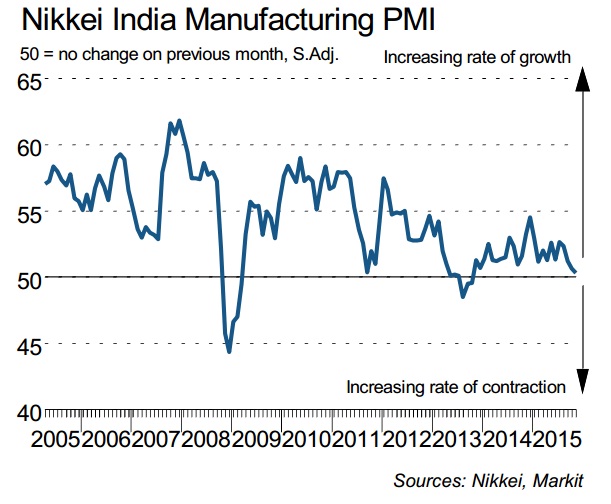

We at FxWirePro, have been arguing for quite some time now that optimism surrounding India is outpacing hard facts that manufacturing is really not growing at commendable pace, which tints the image of 'Make in India' campaign, initiated by Prime Minister Narendra Modi, in his bid to make India, key manufacturing hub in Asia.

While optimism is high, some reforms to ease to do business has been achieved and companies indicated their intention to invest, the hard data is hardly showing progress.

According to latest report from Markit Economics,

- Though manufacturing growth is up for 25 consecutive months, pace of growth is slowing steadily due to slower increase in new businesses and falling output. Headline PMI, dropped to lowest in 25 months to 50.3 in November, fourth consecutive monthly drop.

- Moreover, cost inflation has reached strongest level since May.

Last night, India reported its third quarter GDP growth at 7.4%, which is a major improvement from second quarter GDP growth of 7%.

However, manufacturing growth in India is much weaker than overall growth in GDP.

India's benchmark stock index, nifty is current ly trading at 7955, up 0.25% for the day, while Rupee is trading at 66.5 per Dollar.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices