The manufacturing sector of the Indian sub-continent dropped below the 50-point neutral mark for the first time in 2016 amid a cash crunch scenario and as output as well as new orders dipped during the month of December. Further, companies have reduced their buying levels as input cost accelerated during the period.

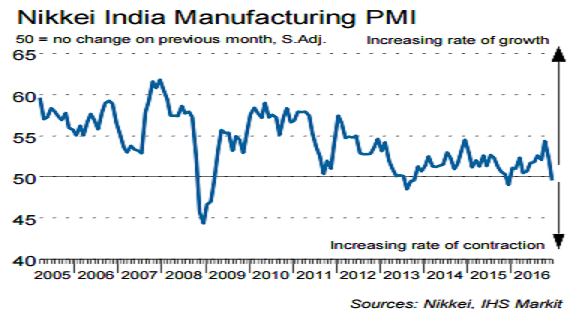

The headline seasonally adjusted Nikkei India Manufacturing Purchasing Managers’ Index (PMI) recorded below the crucial 50.0 threshold for the first time in 2016 during December. Down from 52.3 in November to 49.6, the latest reading was indicative of a marginal deterioration in the health of the sector. Nevertheless, the average over the October-December quarter (52.1) was broadly in line with that seen in the July-September period (52.2).

Four of the five sub-components of the PMI edged below 50.0, while average delivery times stretched further. At the sector level, operating conditions deteriorated in both the consumer and intermediate goods categories.

Cash shortages and lower workplace activity resulted in job shedding and falling buying levels during December. Higher prices paid for a range of raw materials led average cost burdens to increase for the fifteenth straight month in December, with the rate of inflation picking up since November.

Finally, cash flow issues reportedly impaired manufacturers’ ability to work on outstanding business. Backlogs rose for the seventh consecutive month, but at the slowest rate in this sequence.

"As the survey showed only a mild decline in manufacturing production in the last month of the year, the average reading for the Oct-Dec quarter remained in growth terrain, thereby suggesting a positive contribution from the sector to overall GDP in Q3 FY16/17. With the window for exchanging notes having closed at the end of December, January data will be key in showing whether the sector will see a quick rebound," said Pollyanna De Lima, Economist at IHS, Markit.

Meanwhile, the USD/INR traded at 68.02, down -0.20 percent at 8:00GMT.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out