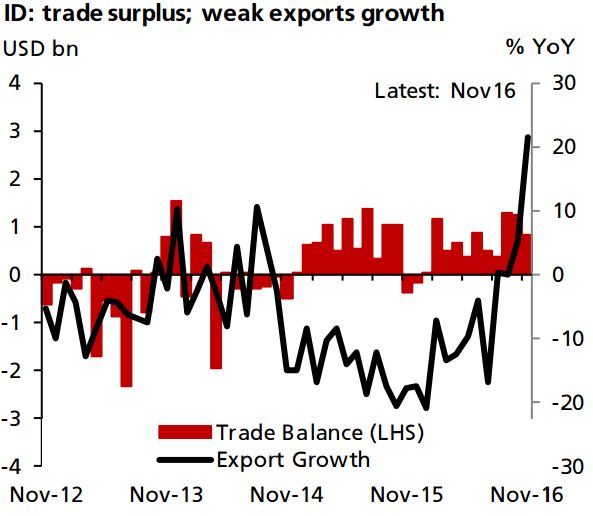

Indonesian trade balance data for December is expected to be released on Monday, January 16 at 04:00 GMT. We foresee that the trade surplus will increase to USD8 billion, higher than the precious reading of USD7.7 billion, supported by the stronger growth in the country’s exports of around 7 percent y/y. The acceleration in export growth in the last-quarter of 2016 was definitely encouraging for the outlook on external balances this year.

Some moderation in the trade surplus may happen this year. Last year’s trade surplus was pretty much a function of poor import growth. As import growth seems to have bottomed out in the last-quarter of 2016, trade balance will come under pressure without help from export growth, reported DBS Group Research.

Also, it is expected that the recovery in energy prices will support the outlook for export growth in the near future. Also, the low base effects from last year shall help.

It is worth noting that the market will primarily focus on the numbers of exports of manufactured goods as its growth has underperformed the region in recent years and it remains to be seen if a catch-up is in the offing this year.

Meanwhile, USD/IDR traded 0.36 percent higher at 13,306 by around 07:00 GMT. Also, 10-year bond yields fell 7 basis points to 7.52 percent.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains