Indonesia’s economic growth is expected to improve slightly to 5.3 percent in 2018 as consumption demand rebounds, according to a recent report from ANZ Research. The Asian games will also help support the economic recovery. The GDP outcome and the expected trajectory are unlikely to influence current monetary policy.

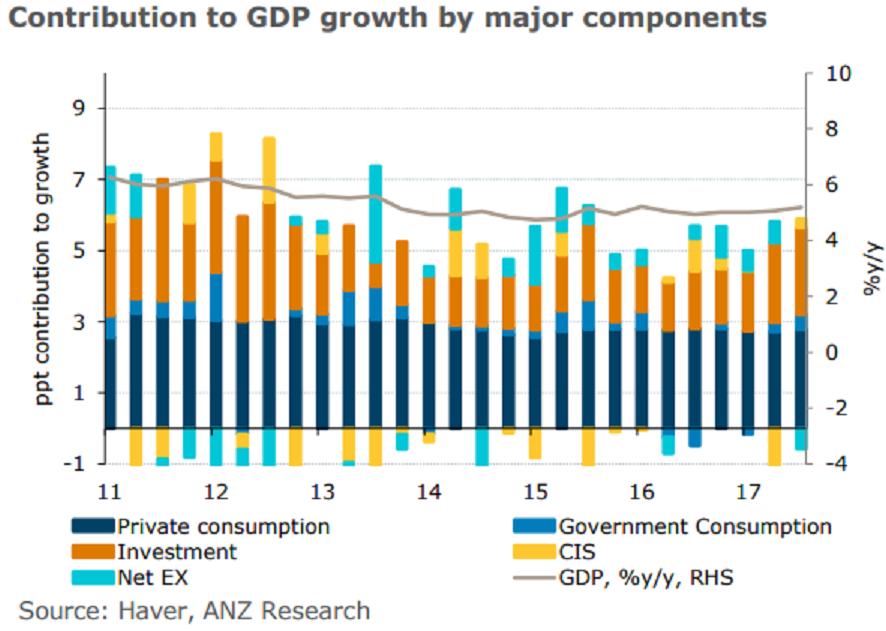

The country’s Q4 GDP growth picked up to 5.2 percent y/y from 5.1 percent y/y in Q3 2017. Government spending and investment were the main drivers of this improvement. Investment remained firm at 7.3 percent y/y in Q4 2017 after rising by 7.1 percent in Q3.

The increase in investment was the fastest since Q3 2013, presumably reflecting an increase in government infrastructure spending. Despite higher commodity prices, net exports shaved off 0.60 ppt from GDP growth due to a faster pace of imports. Growth in private consumption remained tepid at 5.0 percent y/y in Q4. Consumption has been soft for the last few quarters.

For full-year 2017, GDP growth picked up marginally to 5.1 percent from 5.0 percent in the previous year. Indonesia’s growth dynamics are not expected to change in 2018, i.e. GDP growth is expected to improve modestly to 5.3 percent in 2018.

"At the same time, we expect inflation to remain within Bank Indonesia’s (BI) inflation band of 2.5- 4.5 percent. We will, however, keenly watch for the evolution of energy prices and the accompanying policy, i.e. whether they are allowed to adjust in line with international prices or not," the report commented.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations