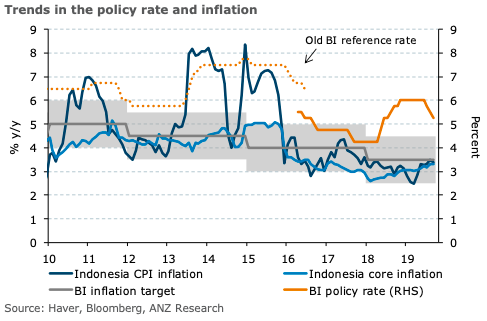

Indonesia’s headline inflation eased to 3.39 percent y/y in September, following two straight months of acceleration. A pullback in volatile food inflation more than offset a pick-up in administered prices and core inflation, ANZ Research reported.

On a sequential basis, headline CPI fell by 0.27 percent m/m in September, the first decline in seven months. The decline was led by food prices, which fell by 1.97 percent.

Most other major categories — such as housing, clothing, healthcare and education — saw prices rise further, but at a slower pace compared to the previous month.

Core CPI, which excludes volatile food and government-controlled prices, rose by 0.29 percent m/m in September, slower than the 0.43 percent gain seen in August. In y/y terms, core inflation edged up to 3.32 percent, the highest since February 2017.

The bottom line is that both headline and core inflation are likely to stay comfortably within the central bank’s 2.5-4.5 percent target band and will not prevent BI from easing monetary policy.

"We continue to see scope for at least one more 25bp cut in BI’s easing cycle, which will take its policy rate to 5.00 percent by end-2019," the report further commented.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Oil Prices Hit Four-Month High as Geopolitical Risks and Supply Disruptions Intensify

Oil Prices Hit Four-Month High as Geopolitical Risks and Supply Disruptions Intensify  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Dollar Struggles as Policy Uncertainty Weighs on Markets Despite Official Support

Dollar Struggles as Policy Uncertainty Weighs on Markets Despite Official Support  U.S.–Venezuela Relations Show Signs of Thaw as Top Envoy Visits Caracas

U.S.–Venezuela Relations Show Signs of Thaw as Top Envoy Visits Caracas  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold and Silver Prices Plunge as Trump Taps Kevin Warsh for Fed Chair

Gold and Silver Prices Plunge as Trump Taps Kevin Warsh for Fed Chair