We look ahead for Banxico to focus on the benevolent macroeconomic environment (such as inflation outlook, job market, retail sales etc) in next week's policy statement.

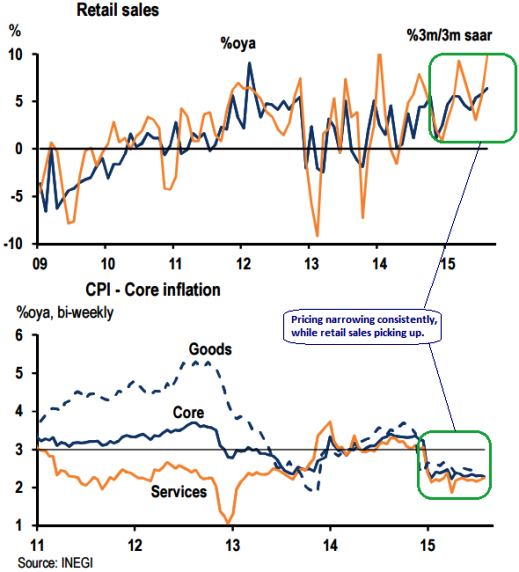

Improving labor market conditions and lower inflation continue to support the solid streak in retail sales.

August sales were much stronger than expected, jumping 1.5%m/m after average gains of 0.8% in the preceding three months.

The inflation (H1 October) came in below expectations again at 0.46% 2w/2w, driving the annual inflation rate to yet another record low at 2.47%.

Non-core inflation drove the decline, while core inflation firmed a touch to 2.5%. With the inflation outlook bright and underlying pressures broadly absent, we expect next week's monetary policy statement to be fairly dovish.

We expect Banxico to trumpet the consolidation of lower inflation, there are other factors that favor a dovish statement overall.

A fragile global economic outlook and the recent postponement of the start of rate normalization in the U.S.

Hence, we believe the Banxico continues to stress the lack of traction in economic activity (both domestic and external), and we also believe the emphasis next week will be on lukewarm external demand and the risks embedded in the deceleration of the two biggest economies in the world.

Trade tip: MXN among few EM currency space typically held in carry basket seem cheap on a real effective exchange rate basis, Sell 3M USD/MXN call vs buy 6M 10D call.

Inflation, retail sales and external/domestic demand prompt Banxico’s conducive policy statements

Thursday, October 29, 2015 12:35 PM UTC

Editor's Picks

- Market Data

Most Popular

6

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom