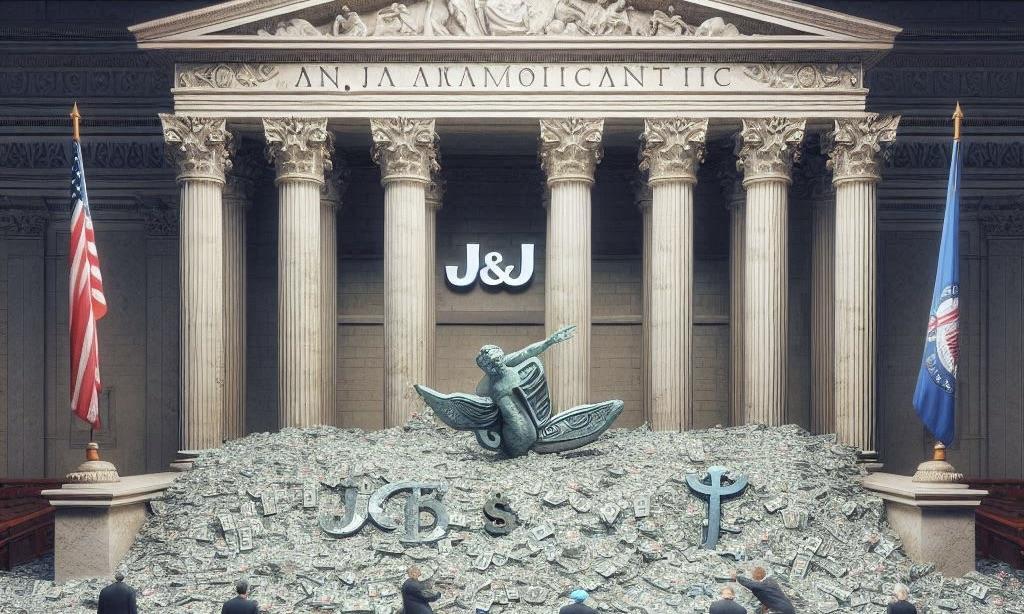

In a bid to resolve over 62,000 lawsuits alleging that its talc products caused cancer, Johnson & Johnson’s subsidiary filed for bankruptcy again. The move seeks to advance a $10 billion settlement that would end ongoing litigation, though opposition from some attorneys remains strong.

Johnson & Johnson Subsidiary Files for Bankruptcy to Push $10 Billion Talc Settlement Forward, Facing Divided Legal Opinions

As the healthcare conglomerate endeavors to advance an approximately $10 billion proposed settlement that would end tens of thousands of lawsuits alleging that the company's baby powder and other talc products caused cancer, a Johnson & Johnson subsidiary filed for bankruptcy for the third time on September 20, per Reuters.

More than 62,000 plaintiffs have filed lawsuits against J&J, alleging that its baby powder and other talc products were contaminated with asbestos and caused ovarian and different types of cancer. Red River Talc, a subsidiary of Johnson & Johnson, filed for bankruptcy protection in a federal bankruptcy court in Houston to halt the litigation.

The organization has refuted the accusations and declared its merchandise secure.

On September 20, Erik Haas, J&J's global vice president of litigation, stated that the settlement is "fair and equitable to all parties" and that 83% of current talc claimants voted in favor of it.

The settlement proposal has divided the attorneys who represent people living with cancer. Opponents of the agreement have stated that they will promptly request that the court dismiss the bankruptcy or transfer it to New Jersey. This is because the courts in New Jersey have previously rejected J&J's attempts to resolve the litigation through a "Texas two-step" bankruptcy.

Andy Birchfield, an attorney who is opposed to the agreement, asserted that J&J is exploiting the bankruptcy system to underpay tens of thousands of people living with cancer.

"We view this so-called vote as another fraudulent effort by J&J to manipulate the bankruptcy process and minimize the legitimate claims of ovarian cancer victims," Birchfield said.

Allen Smith, a lawyer who had previously represented 11,000 claimants in partnership with Birchfield's law firm, was among the attorneys who spoke in favor of the agreement.

Smith said the settlement offer "finally provides my clients reasonable and fair compensation. It's now time to go to work and get them compensated as soon as possible."

J&J employed a "two-step" strategy that transferred liabilities to a newly established subsidiary. This subsidiary subsequently declared Chapter 11, a form of bankruptcy that involves reorganizing assets and debts under the court's supervision. The objective is to utilize the proceeding to compel all plaintiffs to enter into a single settlement without necessitating that J&J file for bankruptcy.

Bankruptcy judges can enforce global settlements that irrevocably halt all related lawsuits and prohibit filing new ones.

Without bankruptcy, any settlement that J&J reached with certain claimants would continue to grant holdouts or future plaintiffs the right to sue, thereby exposing the company to potential multibillion-dollar verdicts that initially motivated it to employ a two-step process.

To enhance its likelihood of success in a third bankruptcy attempt, J&J requested that plaintiffs vote on its proposed agreement in advance to guarantee sufficient backing. For a bankruptcy judge to enforce the deal on all plaintiffs, J&J required a majority of over 75% to endorse the plan.

J&J’s Third Bankruptcy Attempt Focuses on Ovarian Cancer Claims Amid Legal Disputes Over $10 Billion Settlement

J&J's third bankruptcy settlement attempt is also distinct from its previous endeavors in that it exclusively addresses ovarian and other gynecological cancer claims, continuing the company's earlier settlements with state attorneys general and individuals who had sued after developing mesothelioma, a rare form of cancer associated with asbestos exposure.

J&J's proposed resolution would provide approximately $10 billion in compensation to talc claimants over 25 years. After J&J recently agreed to contribute an additional $1.1 billion to the settlement fund and pay $650 million in legal fees to attorneys who had previously opposed the settlement offer, the present value of the settlement is approximately $8 billion.

The business has been embroiled in a contentious dispute with attorneys who oppose its third attempt to resolve the litigation through bankruptcy.

J&J's bankruptcy strategy continues to encounter legal obstacles. These include a June U.S. Supreme Court decision regarding Purdue Pharma's bankruptcy, court orders dismissing its previous endeavors, and proposed federal legislation to prevent financially healthy corporations like J&J from obtaining bankruptcy protection.

Boeing Secures $166.8 Million U.S. Navy Contract for P-8A Engineering and Software Support

Boeing Secures $166.8 Million U.S. Navy Contract for P-8A Engineering and Software Support  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran

Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran  FedEx Faces Class Action Lawsuit Over Tariff Refunds After Supreme Court Ruling

FedEx Faces Class Action Lawsuit Over Tariff Refunds After Supreme Court Ruling  Rio Tinto Advances Gallium Extraction Project in Canada with Federal Funding Support

Rio Tinto Advances Gallium Extraction Project in Canada with Federal Funding Support  Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets

Flare, Xaman Roll Out One-Click DeFi Vault for XRP Yield via XRPL Wallets  United Airlines Boeing 787-9 Makes Emergency Landing in Los Angeles After Possible Engine Fire

United Airlines Boeing 787-9 Makes Emergency Landing in Los Angeles After Possible Engine Fire  Toyota Raises Toyota Industries Buyout Offer Amid Governance Concerns

Toyota Raises Toyota Industries Buyout Offer Amid Governance Concerns  AWS Data Centers in UAE and Bahrain Hit by Drone Strikes Amid Middle East Conflict

AWS Data Centers in UAE and Bahrain Hit by Drone Strikes Amid Middle East Conflict  Blackstone Expands BCRED Investor Payouts Amid Rising Private Credit Market Concerns

Blackstone Expands BCRED Investor Payouts Amid Rising Private Credit Market Concerns  Qantas CEO Warns of Aviation Impact as Oil Prices Surge Amid U.S.-Israel-Iran Conflict

Qantas CEO Warns of Aviation Impact as Oil Prices Surge Amid U.S.-Israel-Iran Conflict  Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline

Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline  Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot

Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot  Nvidia to Launch New AI Inference Processor to Boost OpenAI Performance

Nvidia to Launch New AI Inference Processor to Boost OpenAI Performance  Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal

Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal  OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute

OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute