The GDP data (-0.2%) for Q3 illustrated that Japan is in recession.

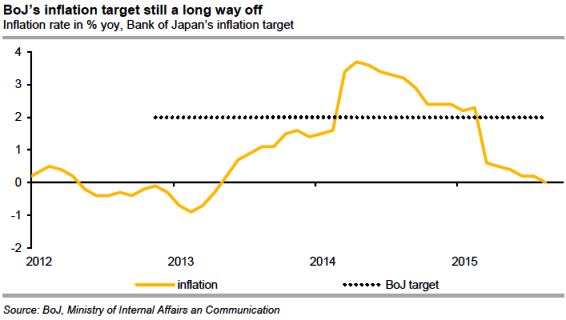

However, while the inflation rate remains at '0' because of which the BoJ cannot breathe a sigh of relief.

Unchanged unemployment claims were stubborn at 3.4% from previous.

If the economy is now also flagging the small flicker of hope that its inflation target of 2% could be reached by March 2017 is dwindling even further.

A tiny little positive signal on the inflation front is the GDP deflator that rose to 2.0% yoy. Even if it leaves everything unchanged at the moment, the BoJ will have to stand to attention.

The last meeting provided the perfect reason for this step as the BoJ corrected its growth and inflation outlook downwards.

As a result hardly any market participants expected the BoJ to take action today and it fulfilled this expectation.

In the end it can still wait and see and watch developments in USD/JPY once the Fed starts the normalization of its monetary policy.

However, it has become clear since Monday at the very latest that the BoJ will have no choice but to become more expansionary again.

Japan sliding into recession mode, 2% inflation target still a major concern for BoJ

Friday, November 20, 2015 9:33 AM UTC

Editor's Picks

- Market Data

Most Popular

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election