Currency options strategy for traders who are risk averse at this juncture bull rally of USD/JPY:

Long guts spreads look attractive since we tend to participate in existing bull rallies. Hence, those who're risky traders can build up fresh longs on guts spreads.

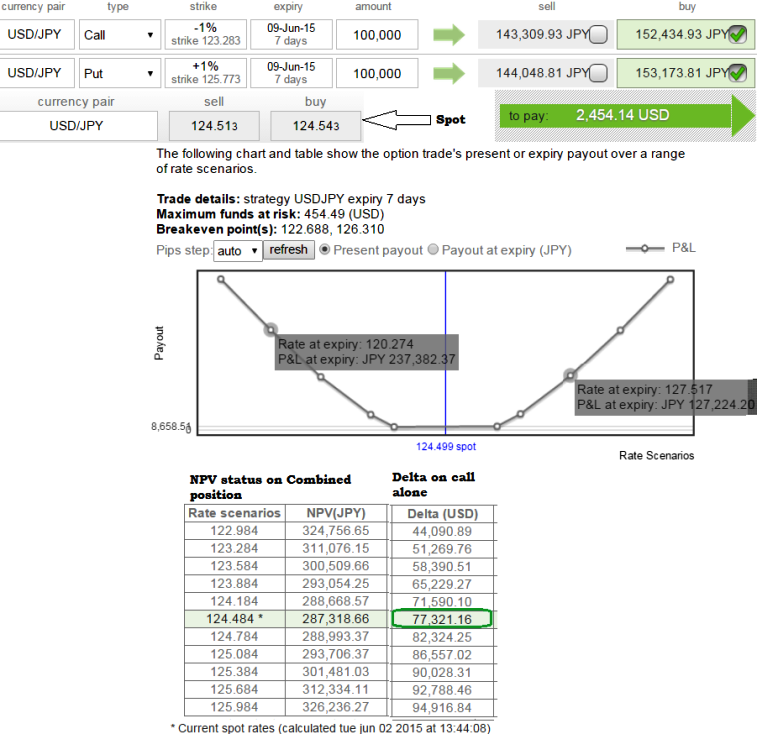

Well, the strategy goes this way, for 100,000 units of exposure it involves the simultaneous buying of an In-The-Money Call (strike at 123.243) and an In-The-Money Put option (strike at 124.492) of the same underlying currency and expiry date.

The combined strategy construction is having positive NPV at 287.318.66 which is an optimal value of entry price.

Delta on call at 0.77% of 100,000 total exposure, this is a positive number for a call option at 77283.26.

This position likely to fetch an unlimited profit and limited risk that is built when the hedger believes the underlying currency to be experienced significant volatility in the near term.

Net debit is required to enter the long guts spread.

Lingering returns on Long Guts for Gutsy bulls

Tuesday, June 2, 2015 8:50 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate