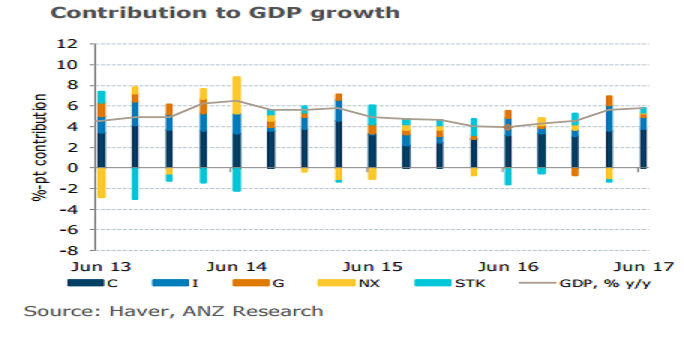

Malaysia’s better-than-expected economic performance was largely driven by private consumption, which printed much stronger than we had expected. Fixed investment, which was the mainstay of GDP growth in the first quarter, normalized in line with our expectations.

Malaysia’s economy expanded a stronger-than-expected 5.8 percent y/y in Q2, faster than the 5.6 percent in the preceding quarter. On a quarter-on-quarter seasonally adjusted basis, GDP grew 1.3 percent compared to the 1.8 percent registered in the preceding quarter. Growth was largely driven by private consumption – with a 54 percent share of GDP, rising 7.1 percent y/y and contributing 3.8ppt to headline GDP growth.

Gross fixed capital formation moderated 4.1 percent y/y, from 10.0 percent in the preceding quarter, contributing 1.1ppt to headline growth. In all, final domestic demand (including inventories) contributed 5.7ppt, while net exports added 0.1ppt to headline growth.

With regard to external balances, the current account surplus widened to 2.7 percent of GDP on a 4-qtr rolling sum basis as compared to 2.2 percent in the preceding quarter, owing to higher surplus in merchandise goods and lower deficits in the services account primary-income accounts. Services balance will be a further drain, given continued dependence on foreign service-providers, particularly in the energy sector.

"We revise our full year 2017 GDP growth forecast to 5.3 percent (prev: 4.9 percent) given the stronger-than-expected Q2 outturn. Implicit in the upward revised full year growth forecast, though, is a growth moderation in H2 of 4.9 percent y/y as compared to the 5.7 percent registered in the preceding quarter," ANZ Research commented in its latest report.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient