German finance minister, Wolfgang Schäuble attributed the rise of the European populists to the policy of European Central Bank (ECB) but in reality, it can really be attributed to Europe’s lost decade and lost generation. No economic region can prosper, when 10 percent of its workforce (not counting the lower participation rate) remains out of work. The unemployment rate has declined from 12.1 percent seen in April 2013, but even after more than 3 years, that rate is quite high at 10.1 percent.

Data shows and the majority of the European institutions including the ECB and the European Council agrees that the biggest of the burden has been shared by the young generations, exactly those who have been attracted by populists.

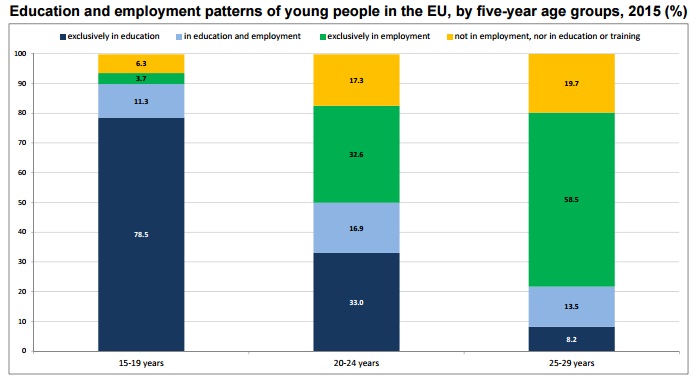

In the decade, beginning in 2006, majority of the countries have seen a big rise in NEET (Neither in employment not in education or training). According to latest figure available for the year 2015, 17.3 percent of the populations aged between 20 to 24 years remain in NEET category. The number is even bigger at 19.7 percent for the age group of 25-29 years. In this decade (2206-2015), NEET, among the population aged between 20 to 24 years, rose 9.5 percent in Italy, 9.3 percent in Greece, 9 percent in Spain, 8.5 percent in Cyprus and 7.8 percent in Ireland. A survey by Lord Ashcroft Polls the risk of the rise in leftwing or rightwing populism is particularly high in these countries. The matter has been worsened by the influx of refugees that finally triggered a reversal of what Europe has achieved for last four decades. The people of the United Kingdom, where the number has risen by 4.4 percent have already voted to leave the European Union. It is high time that the European countries take note and act decisively, first of which should be taking the stimulus baton from ECB and to pursue reforms in a lightning fashion.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off