'Amazon is getting into sports collectibles by investing in fractional marketplace Dibbs, which recently launched a feature allowing users to sell stakes in their items with each other.

The terms of Amazon's investment have not been made public, but Dibbs did raise US$16 million in Series A funding in July.

Among Dibbs' investors are Foundry Group and Tusk Venture Partners and athletes Channing Frye, Chris Paul, Kevin Love, DeAndre Hopkins, Kris Bryant, and Skylar Diggins-Smith.

As large sums are involved, some sports collectibles have become prohibitive to potential buyers and minimize the market for owners who wish to monetize their assets.

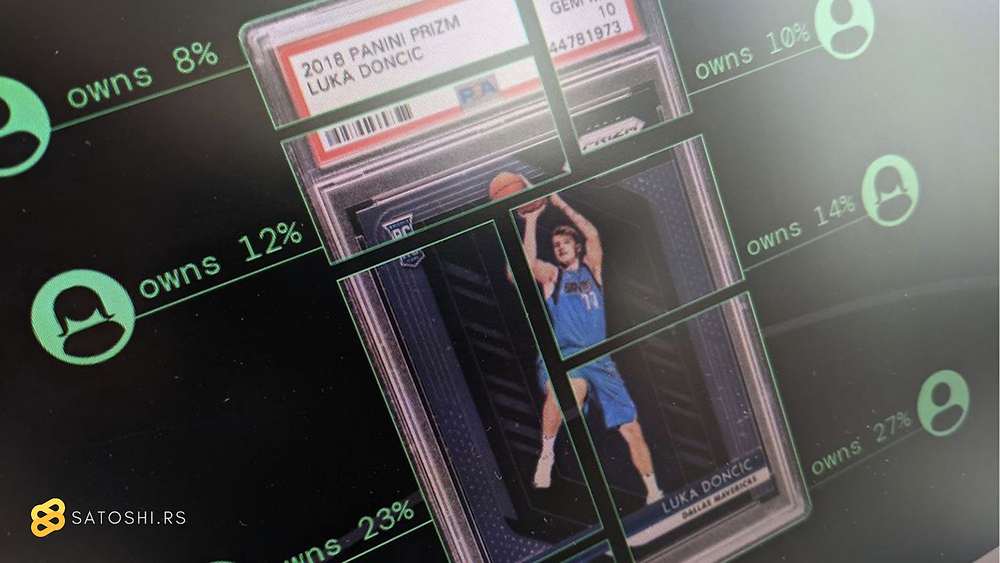

Dibbs was founded in 2020 to offer fractional shares of cards and NFTs, making it more affordable to participate while letting collectors unlock value without ceding total ownership.

Dibbs stores and insures any card listed on the platform and charges a 2.9 percent commission per transaction.

If anyone acquires a 100 percent stake in an asset, they can take possession and ship it to their home.

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Trump Plans UFC Event at White House for America’s 250th Anniversary

Trump Plans UFC Event at White House for America’s 250th Anniversary  What makes a good football coach? The reality behind the myths

What makes a good football coach? The reality behind the myths  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Signs Executive Order Targeting Big-Money College Athlete Payouts

Trump Signs Executive Order Targeting Big-Money College Athlete Payouts  Trump Threatens Stadium Deal Over Washington Commanders Name

Trump Threatens Stadium Deal Over Washington Commanders Name  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Native American Groups Slam Trump’s Call to Restore Redskins Name

Native American Groups Slam Trump’s Call to Restore Redskins Name  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock