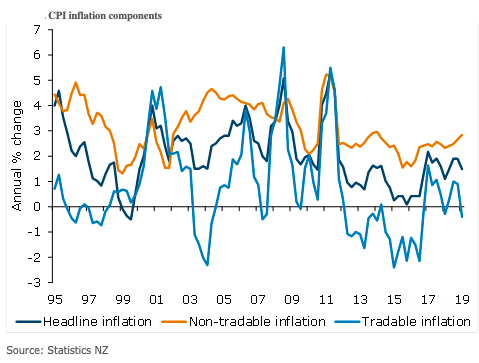

New Zealand’s CPI increased 0.1 percent q/q in Q1 2019, below the 0.2 percent q/q rise incorporated in the RBNZ’s February MPS, and below ANZ and market expectations. Annual inflation dipped to 1.5 percent y/y, from 1.9 percent.

However, the details of the release add to the case that a cut in the OCR is not a matter of urgency. The RBNZ will take some comfort from stronger domestic inflation, as expected (+1.1 percent q/q), with weakness concentrated in the relatively volatile and transitory tradable component (-1.3 percent q/q).

Today’s print for CPI inflation was slightly below the 0.2 percent q/q rise incorporated in the RBNZ’s February MPS. But the details of the print were broadly in line with their expectations, with volatility in tradable prices driving the RBNZ miss.

Looking forward, a lower NZD should start to feed more fully into tradable prices, and oil has already rallied 50 percent from the December low. This will result in a higher tradable inflation forecast in the May MPS, limiting any perceived risk of lower inflation expectations affecting pricing, ANZ Research reported.

Most importantly, non-tradable inflation was bang on the RBNZ’s expectation. While inflation is a lagging indicator, the RBNZ will take a degree of comfort from the fact that non-tradables is at its highest level in five years, with weakness concentrated in the volatile and transitory tradable component.

A large proportion of the quarterly pick-up in non-tradable inflation was due to regulated prices (tobacco and education). Core inflation measures tracked broadly sideways, continuing to stabilise following strength earlier in 2018.

Meanwhile, the annual 30 percent trimmed mean dipped a touch to sit at 1.9 percent. The weighted median was stable at 2.2 percent y/y, and inflation excluding food and energy remained at 1.5 percent. The focus now turns towards the RBNZ’s sectoral factor model for confirmation of the stable core inflation signal.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals