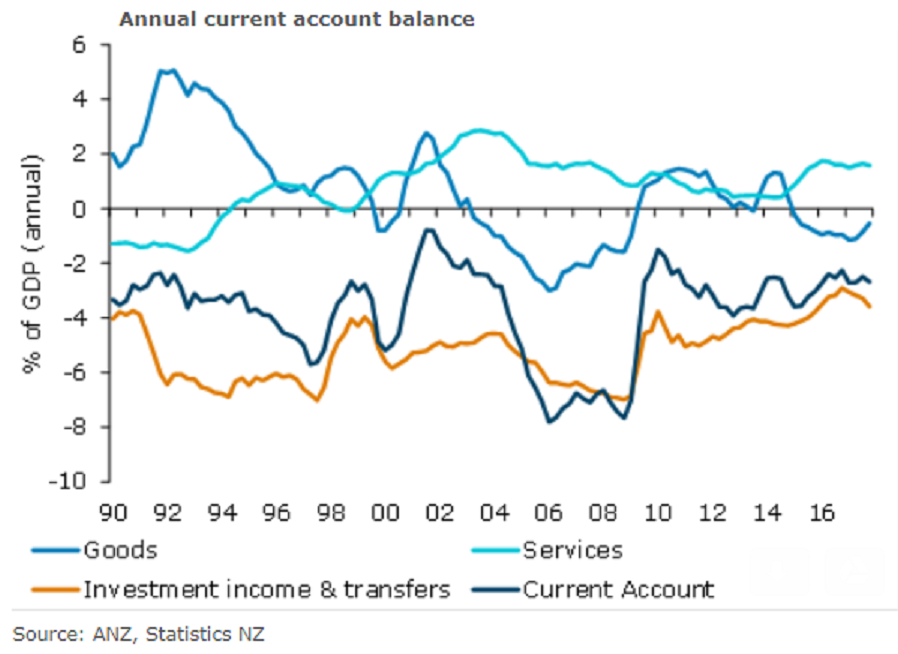

New Zealand’s unadjusted current account deficit was slightly larger than expected in Q4, which saw a widening of the annual balance to 2.7 percent of GDP, from a revised 2.5 percent (previously 2.6 percent) in Q3. Despite the small surprise in today’s release, the deficit remains well below its historical average of 3.6 percent of GDP.

In seasonally adjusted terms, the current account deficit widened by NZD0.4 billion to NZD2.0 billion. The widening was driven entirely by a widening goods deficit to NZD0.5 billion from NZD0.1 billion in Q3, with strong imports offsetting a solid rise in exports.

The services surplus remained stable at NZD1.2 billion. Travel services exports lifted 1.4 percent, reflecting a thriving NZ tourism sector. The income deficit remained broadly stable overall, with offsetting movements across the primary and secondary balance. At NZD2.7 billion, the income deficit remains the largest component of New Zealand’s current balance, as it always has.

The external balance sheet continues to look in reasonable shape (by New Zealand’s standards at least). In large part due to valuation changes, the net international liability position fell by almost NZD1 billion to NZD155.2 billion. As a share of GDP, it fell to 54.8 percent, a new record low.

"We believe external imbalances are acting as a greater constraint on growth than is widely appreciated. That may sound surprising given both the current account deficit and external balance sheet are far healthier than is typical at this point in the cycle. But with more regulator and credit rating agency scrutiny over external borrowing, more onus is falling on saving to fund domestic investment. There are no obvious implications from today’s data for GDP figures, when we expect to see a 0.7 percent q/q expansion in real GDP," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns