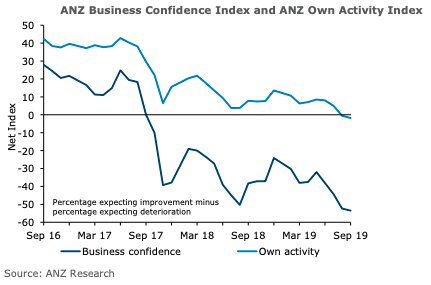

New Zealand’s ANZ Business Outlook Survey headline business confidence for the month of September fell 2 points, with a net 54 percent of respondents reporting that they expect general business conditions to deteriorate in the year ahead, the lowest since April 2008.

Firms’ expectations for their own activity over the year ahead fell 1 point to -2, the fourth fall in a row, and the lowest read since April 2009. Employment intentions rose 1 point to a net 8 percent of firms intending to reduce employment.

Investment intentions fell 5 points to -9, revisiting its lows of a year ago. Capacity utilisation fell 1 point and is near decade lows. Profit expectations fell 5 points to a net 25 percent of respondents expecting profitability to decline, the lowest since April 2009.

A net 40 percent of firms expect it to be tougher to get credit, up 1. Price-side indicators were weak. Pricing intentions fell 2 points to a net 18 percent of firms expecting to raise prices. Cost pressures fell 2 points to +47.

Inflation expectations fell from 1.70 percent to 1.63 percent – they have fallen half a percent this year to be well under the 2 percent CPI target midpoint. Commercial construction intentions fell 9 points to -13; residential construction intentions fell 15 points to -19. Both remain negative. Export intentions rose 3 points to a net 2 percent of firms expecting exports to lift. This is quite muted considering the size of the fall in the exchange rate.

The Reserve Bank will be disappointed that its unexpectedly large 50bp cut in the Official Cash Rate (OCR) last month does not appear to have had much impact on business’ sentiment or investment and employment intentions.

Meanwhile, one positive is that construction sector employment intentions have bounced back, though they are still negative. Construction accounts for 9 percent of employment. But there is still no sector of the economy that reports on net that it is planning on hiring more staff – that hasn’t happened since 2009.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality