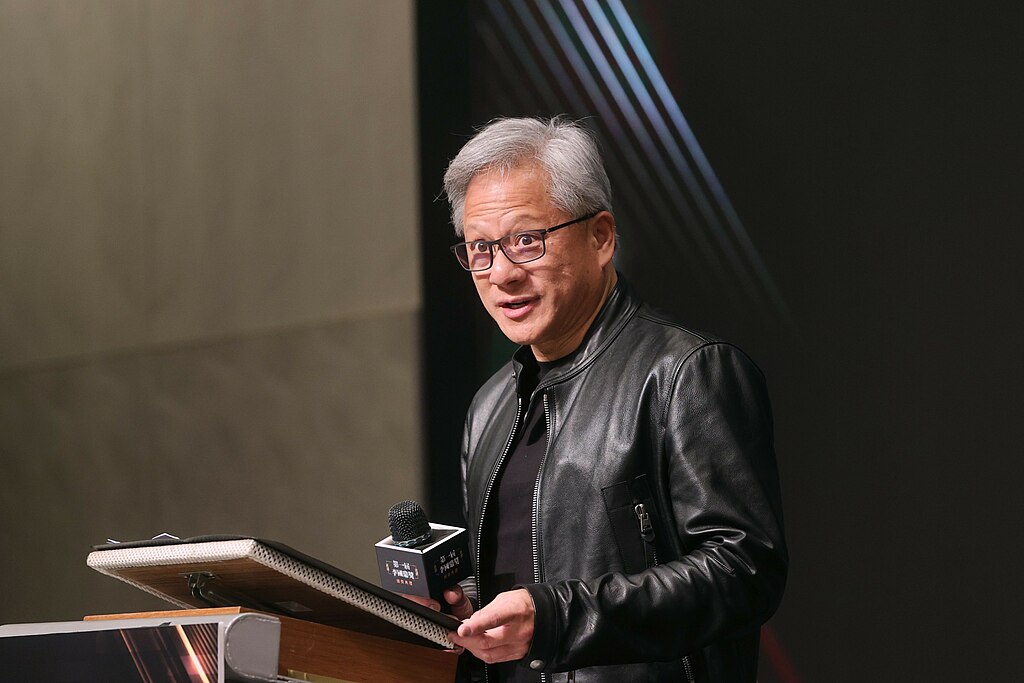

Nvidia (NASDAQ: NVDA) CEO Jensen Huang is set to visit Beijing next week ahead of the expected launch of a China-specific AI chip, according to the Financial Times. The upcoming chip is a modified version of the Blackwell RTX Pro 6000, redesigned to comply with tightened U.S. export regulations imposed under former President Donald Trump.

The chip, reportedly scheduled for release in September, omits advanced features such as high-bandwidth memory and NVLink connectivity to ensure compliance with U.S. restrictions. Despite the hardware limitations, Chinese companies remain keen on the product, primarily due to the high switching costs from Nvidia’s CUDA software ecosystem, which dominates AI development globally.

During his trip, Huang is expected to attend the International Supply Chain Expo in Beijing, where he aims to meet Premier Li Qiang and other top Chinese officials. The visit underscores Nvidia’s commitment to the Chinese market, which contributed $17.1 billion to its revenue last year.

However, actual sales of the chip in China hinge on regulatory approval from Washington. Nvidia is reportedly awaiting confirmation that the new design will not be subject to further export bans before beginning shipments.

Huang’s visit comes at a critical time as Nvidia navigates growing geopolitical tensions and increasing regulatory scrutiny while trying to maintain its foothold in the vital Chinese AI market. The company's strategy to tailor hardware for China illustrates a broader trend among U.S. tech firms seeking to adapt to evolving export rules while retaining access to one of the world’s largest markets.

This move could shape Nvidia's competitive position amid rising global demand for AI chips and ongoing U.S.-China tech rivalry. Investors and analysts will be watching closely for updates on both regulatory decisions and reception from Chinese officials.

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off