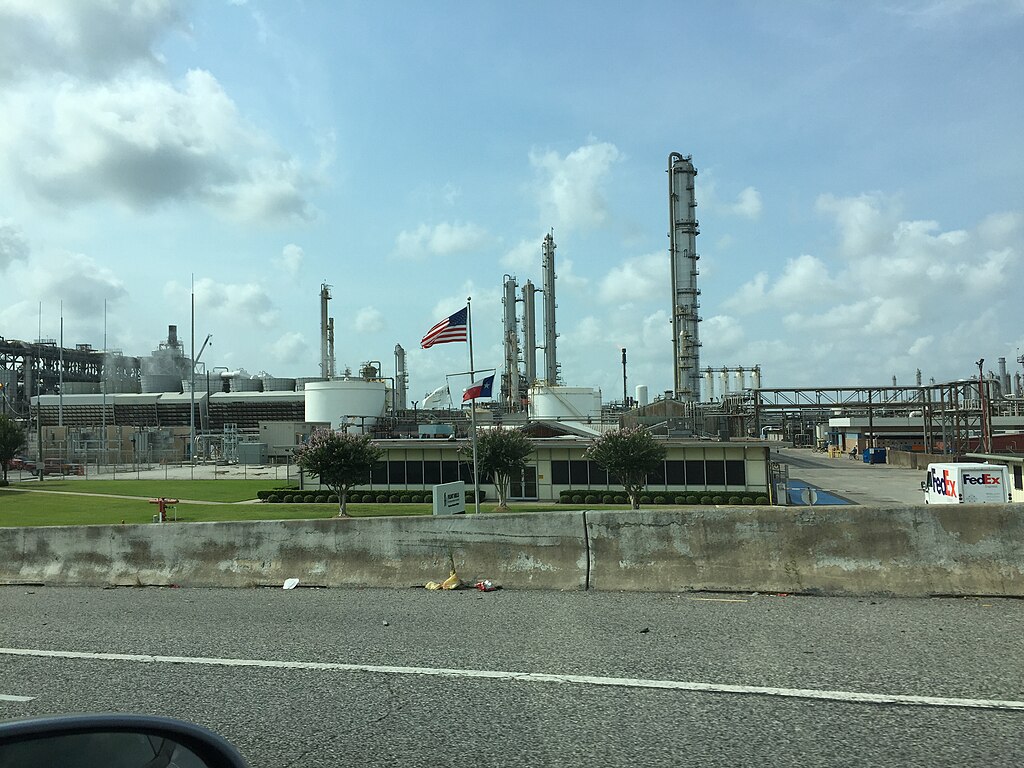

Oil prices eased in Asian trading on Tuesday as President Donald Trump announced measures to boost U.S. energy production and delayed new tariffs. Brent crude futures slipped 0.14% to $80.04 per barrel, while West Texas Intermediate (WTI) crude for March fell $0.67 to $76.72. The February WTI contract expires Tuesday, with no U.S. market settlement on Jan. 20 due to a holiday.

Trump revealed a plan to expedite oil, gas, and power permitting, aiming to maximize U.S. energy output. He also postponed a potential 25% tariff on imports from Canada and Mexico until Feb. 1. This delay eased immediate price pressures, but future tariffs on Canadian crude could increase market volatility. Canadian oil exports, primarily sold to the U.S. at a discount to WTI, face potential cost hikes under U.S. sanctions, according to Commonwealth Bank analyst Vivek Dhar.

Additionally, Trump stated the U.S. might halt oil purchases from Venezuela, its second-largest supplier after China. This could further disrupt global supply chains. Meanwhile, his promise to refill strategic reserves may bolster demand for U.S. crude, supporting prices in the long term.

While new trade measures were not implemented immediately, Trump directed federal agencies to investigate unfair practices by trading partners. These developments add uncertainty to the global oil market as traders assess the impact of potential policy changes.

The shifting dynamics underscore the complex interplay of energy production, international trade, and geopolitical considerations influencing oil prices.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Ukraine-Russia Talks Yield Major POW Swap as U.S. Pushes for Path to Peace

Ukraine-Russia Talks Yield Major POW Swap as U.S. Pushes for Path to Peace  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue